Jun/iStock through Getty Photos

Funding Thesis

Listed below are a number of stunning details concerning the Pharmaceutical / Biotechnology corporations Organon (NYSE:OGN) and Viatris (NASDAQ:VTRS).

Firstly, each of those corporations – which started buying and selling on June third, 2021 (Organon) and November sixteenth 2020 (Viatris) – are dividend payers.

Organon declared a quarterly dividend of $0.28 per share when asserting its FY21 outcomes a number of days in the past, and Viatris – but to launch FY21 earnings – introduced in January that it will be growing its quarterly dividend by 9%, to $0.12 per share.

Viatris and Organon’s dividend yields are due to this fact 3.25% and three.1%, which is greater than respectable for corporations which are respectively simply over, and just below 1 12 months outdated.

Viatris was fashioned through a merger between the legacy manufacturers division of Pfizer (PFE), which the Pharma large elected to spin out, and the generics large Mylan, while Organon was fashioned after the massive pharma Merck (MRK) elected to spin out its Girls’s Well being, Biosimilars and Established Manufacturers divisions into a brand new entity.

That won’t sound like a sound foundation for launching an investable firm – siphoning off your poorly performing property – in Viatris’ case manufacturers corresponding to Viagra, ache remedy Lyrica, and ldl cholesterol decreasing Lipitor, which have lengthy since misplaced their patent exclusivity; and in Organon’s a struggling Girls’s Well being division, and 49 branded merchandise which are not patent protected – and asking a brand new administration workforce to someway make them worthwhile once more.

If we have a look at some funding fundamentals in relation to every firm, nevertheless, the numbers inform us a totally completely different story – specifically that each corporations are considerably undervalued.

Throughout the total 12 months 2021, Organon earned $6.3bn of revenues, which met the upper finish of its forecasting and offers the corporate a value to gross sales ratio of ~1.5x, which is a really low determine. Non-GAAP adjusted diluted EPS was calculated at $6.54, which provides a ahead P/E ratio of 5.6x.

As talked about, Viatris is but to launch its ultimate monetary outcomes for 2021, but when steering of $17.8bn on the midpoint is met, Viatris will document a value to gross sales ratio of virtually precisely 1x – exceptionally low – and utilizing internet money offered by working actions as an alternative choice to internet revenue, the ahead P/E ratio will be calculated as ~6x.

To place that in context, we are able to examine these outcomes to different main corporations thought to be exceptionally sturdy investments – inside and with out the Pharmaceutical trade.

Apple (AAPL) has a P/S ratio of 8x, and a P/E ratio of 29x. Amazon (AMZN) has a P/S ratio of three.5x, and a P/E ratio of 49x. Google (GOOG) (GOOGL) has a P/S ratio of seven.25x, and a P/E ratio of 24.5x.

Amongst Pharmaceutical corporations, Johnson & Johnson (JNJ) has a P/S ratio of 4.8x and a P/E ratio of 21.4x, Pfizer (PFE) has a P/S of three.5x and a P/E of 13x, and Merck has a P/S of 4x and a P/E of 15x.

In different phrases, Pfizer and Merck’s spinouts are apparently the superior funding choices when in comparison with their mum or dad corporations, and by comparability to lots of the most profitable shares and companies, their valuations seem like staggeringly low.

That, in a nutshell, is why Viatris and Organon supply traders an nearly distinctive alternative to put money into an organization that by most key measures is considerably undervalued, though there are extra causes apart from.

Each corporations have thrilling alternatives inside the biosimilar medication sector – one of many quickest rising areas of the pharmaceutical trade – each have a worldwide presence and infrastructure already in place – and each profit from extremely skilled administration groups, able to draw a number of the finest expertise round.

There are some caveats to pay attention to nevertheless – a mantra that’s usually repeated on the planet of investing is that if it sounds too good to be true, then maybe it’s. Each corporations’ legacy property will bleed revenues over time as medical doctors flip to extra trendy and efficient remedies, and each corporations have a excessive stage of economic leverage.

On this submit, I’ll examine and distinction the two corporations to attempt to current potential (or present) traders with a balanced view of every firm, their strengths, weaknesses, alternatives and threats, variations to at least one one other, and prospects for progress – when it comes to income technology, profitability, and valuation.

Viatris Is The Greater Firm, With Higher Progress Prospects Thanks To Mylan Merger

By way of market cap valuation – $18.3bn versus $8.8bn – Viatris is the a lot bigger firm, which is right down to the truth that it was fashioned not solely by the Pfizer Upjohn division spin-out, but additionally through a merger with Mylan.

In a earlier observe on Viatris, I mentioned a number of the causes traders may need for being suspicious of Mylan. The Netherlands primarily based generic drug producer’s Chief Government Robert Coury – now Government Chairman of Viatris – as soon as acquired $97m in annual compensation, on the identical time Mylan was being pressured to pay $465m in fines to the Division of Justice for overcharging Medicaid for its flagship EpiPen product.

EpiPen is now a key pillar of Viatris’ Manufacturers division – we do not have the FY21 figures but, however in Q321, Manufacturers – which additionally contains the likes of Viagra, Lyrica and Lipitor and blood strain drug Norvasc – contributed $2.8bn of Viatris whole revenues of $4.52bn, or ~62%. The remaining 2 divisions – Complicated GX and Biosimilars, and Generics, contributed $332m, and $1.39bn, or 7% and 31%.

Progress Inside Girls’s Well being Division Might Not Be Sufficient To Drive Lengthy Time period Progress At Organon

Within the case of Organon, throughout FY21, its Girls’s Well being division contributed $1.6bn of revenues, or 26% of all revenues earned, while its Biosimilars division contributed 7%, Established Manufacturers 65%, and others <2%.

Due to this fact Viatris and Organon have an nearly equivalent publicity to their legacy or established manufacturers divisions – 62% and 65% – which, greater than something, drives down their market valuations, as a result of traders anticipate these income streams to maintain falling within the face of recent competitors, with no patent safety.

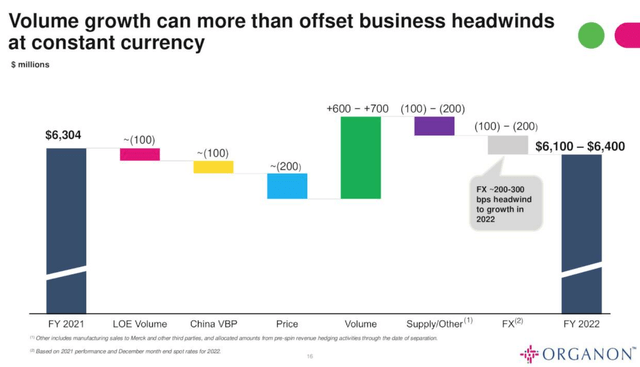

In accordance with Viatris Q321 knowledge, the Established manufacturers division was down simply 3% year-on-year, while Organon’s FY21 knowledge means that gross sales fell by 10% year-on-year. Organon, nevertheless, which makes 75% of its Established Manufacturers gross sales abroad, believes that it might probably make up in quantity what it’s shedding in lack of exclusivity (“LOE”), and decreasing costs, as proven under.

Organon illustrates the way it can keep present income technology by means of 2022. (Organon FY21 Earnings Presentation)

The truth that Organon expects its revenues to fall solely barely in 2022, or maybe under no circumstances, is an encouraging signal for traders, though if Organon is to make real headway, and obtain natural progress, administration should discover a solution to revive a Girls’s Well being division that had fashioned an underwhelming a part of Merck’s enterprise.

Organon’s technique on this regard appears to be to spend its manner out of hassle, as I mentioned in a November Searching for Alpha submit on the corporate. Alydia Well being – and its JADA system designed to cease extreme bleeding after childbirth – was acquired for $240m, and Forendo Pharma was acquired for $75m upfront plus as much as $870m of potential improvement and gross sales milestone funds, to achieve entry to its endometriosis (which impacts ~170m girls globally) remedy pipeline. Ebopiprant was additionally acquired – a Section 2 stage asset indicated for remedy of preterm labor, which impacts an estimated 15 million infants.

Organon desires to drive its Girls’s Well being division revenues by 10% every year to erase any deficit created by falling Established Manufacturers gross sales – it’s a robust ask, however encouragement will be taken from the efficiency of contraception remedy Nexplanon, whose gross sales in FY21 reached $769m – up 13% year-on-year.

It would take 2-3 years earlier than any new merchandise come to market, nevertheless, and by my tough calculation, an extra ~$160m of revenues every year throughout Girls’s Well being just isn’t going to be sufficient to make up a ten% annual drop in Established Manufacturers income, which might be extra like ~$400m. Organon should proceed to stabilise Established Manufacturers losses, and I really imagine this can be potential.

Viatris’ Biosimilars Division & World Attain Might Give It The Edge

Biosimilars – a “organic product that’s similar to a reference biologic and for which there are not any clinically significant variations when it comes to security, purity, and efficiency” (supply: Medication.com) – is a vital, rising and controversial a part of the pharmaceutical panorama.

A biosimilar is similar to a generic, however its organic profile just isn’t equivalent to the drug it’s making an attempt to mimic – as long as the efficacy and security match the drug, nevertheless, the biosimilar can get round a number of the restrictions that apply to generic medication.

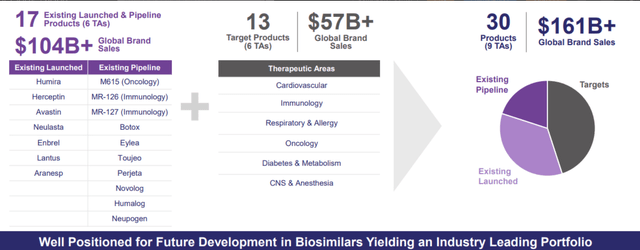

With drug pricing a continuously recurring situation in Pharma, biosimilars – which are probably cheaper to fabricate and may undercut established medication on value – are thought-about to have huge progress potential – a slide from Viatris’ 2021 Investor Day presentation makes the purpose powerfully.

Viatris Investor Day Presentation discusses biosimilars alternative (Viatris investor day presentation)

In essence, Viatris believes there’s ~$161bn of revenues up for grabs, if biosimilars will be dropped at market that precisely match the efficiency of the medication whose mechanism of motion (“MoA”) they’re designed to imitate. Beneath is Viatris’ biosimilars pipeline as of Q321.

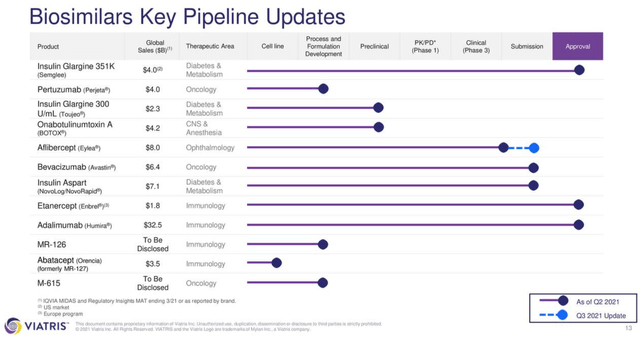

Viatris biosimilars pipeline at a look. (Q321 earnings presentation)

As we are able to see, a number of the targets already lined up by Viatris are compelling. In July, the FDA accredited Viatris’ Semglee – an insulin glargine biosimilar of Sanofi’s (SNY) Lantus, a drug that after earned peak gross sales of $7bn every year, albeit lower than $1bn in 2021. Hulio – a biosimilar of Humira, AbbVie’s (ABBV) >$20bn every year promoting anti-inflammatory remedy – has been launched in Canada,

An Aflibercept biosimilar seems to be to be nearing approval, able to difficult for market share in opposition to Regeneron’s (REGN) $8bn every year promoting Eylea, while Botox and a variety of most cancers drug biosimilars promise to genuinely shake up the prescription drug panorama. There’s bipartisan authorities strain on drug pricing, and biosimilars, which generally enter {the marketplace} at a 15%-35% low cost to the branded drug, could possibly be a major a part of the answer.

Viatris is a very worldwide firm, leveraging each Pfizer and Mylan’s gross sales and advertising and marketing networks and world R&D centres, which is one other benefit within the biosimilars race.

In Q321, Viatris earned 18% of its revenues in creating markets, 11% in Japan, Australia and New Zealand, and 13% in Higher China. These areas would seemingly profit disproportionately from entry to cheaper biosimilars, presenting a big progress alternative.

Organon additionally has a biosimilars division, however presently it isn’t in the identical league as Viatris’, nor does it appear to be the corporate’s primary precedence, which is Girls’s Well being, as mentioned above.

That does not essentially imply it ought to be discounted, nevertheless. Organon has a business partnership with Samsung, whose Bioepis division is anticipated to develop into a serious participant in biosimilars, and gross sales of its 3 accredited biosimilars – Renflexis, Ontruzant and Brenzys – for autoimmune circumstances, breast most cancers remedy trastuzumab and plaque psoriasis respectively – had been up >10% year-on-year, to $424m.

Debt Weighs Closely On Each Firms

After all, when spinning out their legacy property and sure different companies, Pfizer and Merck additionally noticed a possibility to eliminate a few of their soiled laundry additionally – specifically substantial parts of debt.

Organon’s internet debt stood at $9bn in June 2021, and it stood at $8.4bn on the finish of 2021, in keeping with administration, which represents progress, however with curiosity expense $400m in 2021, and forecast to be the identical subsequent 12 months, Organon’s debt is consuming into its profitability, which is a disgrace.

In Viatris’ case, the corporate’s present liabilities as of Q321 are said to be $10.1bn, and its long-term debt place $19.9bn, which provides administration a mountain to climb.

Viatris’ CEO Michael Goettler has promised to pay down $6.5bn of debt by 2023, roughly the identical as its annual EBITDA, while free money circulation technology is anticipated to be ~$2.5bn. Clearly, the debt burden is excessive, however a minimum of Viatris has been capable of introduce a dividend, though throughout the primary 9 months of 2021 its R&D spending was simply 3% of its whole revenues, which strikes me as worryingly low.

Conclusion – Viatris Is The Bigger & Has Higher Progress Potential However Organon Has The Momentum – Contemplate Holding Each

As I’ve mentioned on this submit, once we research funding fundamentals, Viatris and Organon are evenly matched, and their P/S and P/E ratios are extremely engaging and suggestive of great upside potential. From a debt perspective, neither seems to be to be in an incredible place, however there’s a minimum of no menace to the dividend, which I might anticipate to develop.

R&D funding at each corporations is maybe a bit skinny, presently, which raises questions as to how the falling gross sales of legacy manufacturers shall be changed. However with that stated, I’ll have been much less optimistic than I ought to have been in relation to Organon’s Girls’s Well being division – it is a projected $40bn market, its administration believes – and I believe I’ve been clear about my enthusiasm for Viatris’ alternative in biosimilars.

The wedding of Pfizer and Mylan derisks Mylan with established manufacturers as ballast for the experimental biosimilars division, and brings a very world community into play, while Organon might lack the scale and scale of Viatris, however advantages from 49 merchandise with a few years of sturdy gross sales left in them, handing the enterprise the regular money circulation technology it requires to develop into a worldwide chief in Girls’s Well being – that’s the idea a minimum of.

Though there’s an argument to say that each Viatris and Organon won’t current financials as sturdy as in 2021 for a few years to return, as legacy manufacturers gross sales erode, I want to take a extra optimistic outlook and think about simply how low cost every of those inventory costs are presently, and even taking a look at 2022 steering.

I’m tempted to check the two corporations with Abbott Laboratories’ (ABT) spinout of AbbVie in 2012 – AbbVie shares are up >300% since that point, though largely because of Humira, whose runaway success was sudden on the time.

As long as revenues at each corporations stay comparatively steady, as the brand new enterprise divisions are given time to develop and ship, I stay assured that firm valuations will climb, because the debt pile shrinks, permitting each corporations’ managements to develop into bolder and extra adventurous.