- Reviews Whole Revenues of $4.12 Billion; U.S. GAAP Internet Earnings of $314 Million; Adjusted EBITDA of $1.48 Billion; U.S. GAAP Internet Money Supplied by Working Actions of $803 Million; and Free Money Circulation of $719 Million

- Sturdy First Half 2022 Money Circulation; Roughly $1.9 Billion of U.S. GAAP Internet Money Supplied by Working Actions and Roughly $1.8 Billion in Free Money Circulation

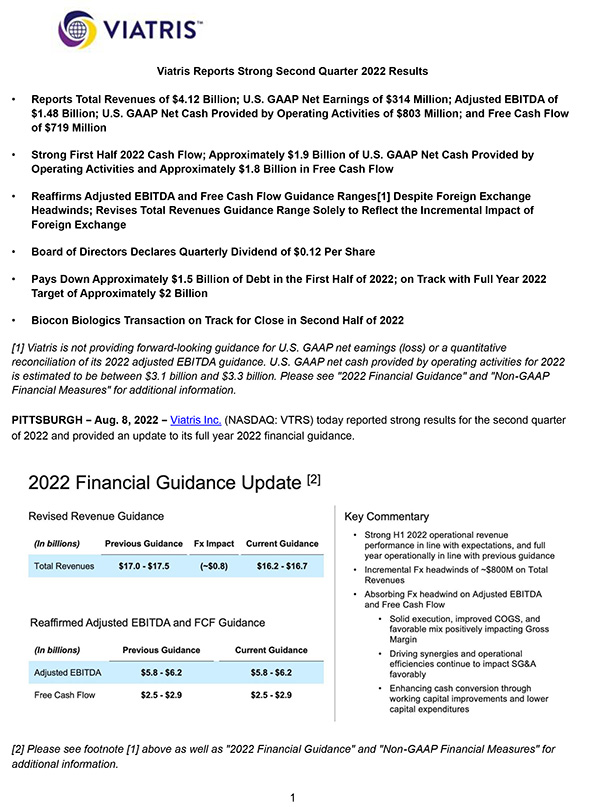

- Reaffirms Adjusted EBITDA and Free Money Circulation Steering Ranges[1] Regardless of International Trade Headwinds; Revises Whole Revenues Steering Vary Solely to Mirror the Incremental Impression of International Trade

- Board of Administrators Declares Quarterly Dividend of $0.12 Per Share

- Pays Down Roughly $1.5 Billion of Debt within the First Half of 2022; on Observe with Full 12 months 2022 Goal of Roughly $2 Billion

- Biocon Biologics Transaction on Observe for Shut in Second Half of 2022

[1] Viatris is just not offering forward-looking steering for U.S. GAAP web earnings (loss) or a quantitative reconciliation of its 2022 adjusted EBITDA steering. U.S. GAAP web money supplied by working actions for 2022 is estimated to be between $3.1 billion and $3.3 billion. Please see “2022 Monetary Steering” and “Non-GAAP Monetary Measures” for added info.

PITTSBURGH, Aug. 8, 2022 /PRNewswire/ — Viatris Inc. (NASDAQ: VTRS) at this time reported robust outcomes for the second quarter of 2022 and supplied an replace to its full yr 2022 monetary steering.

[2] Please see footnote [1] above in addition to “2022 Monetary Steering” and “Non-GAAP Monetary Measures” for further info.

Viatris additionally introduced that its Board of Administrators declared a quarterly dividend of twelve cents ($0.12) for every issued and excellent share of the corporate’s frequent inventory. The dividend is payable on Sept. 16, 2022, to shareholders of report on the shut of enterprise on Aug. 24, 2022.

Viatris CEO Michael Goettler stated: “We’re hitting on all cylinders operationally, even whereas overseas trade charges proceed to be difficult, and have now demonstrated six consecutive quarters of robust efficiency. We proceed to ship on our monetary and strategic commitments and are making good progress on all of the reshaping initiatives introduced in February, together with the additional ramp up of our inorganic exercise in our International Healthcare Gateway.”

Viatris President Rajiv Malik stated: “We consider our robust and constant operational execution displays the resilience of a diversified enterprise that has been constructed intentionally to make sure we aren’t depending on anyone market or product and permits us to stay agile and opportunistic to carry out persistently throughout all geographies. Trying forward, we’re very excited to construct upon our robust legacy in improvement and leverage our in depth scientific capabilities to proceed transferring up the worth chain. By our International Healthcare Gateway, we anticipate to additional strengthen our deep pipeline to develop extra 505(b)(2)s and new chemical entities within the beforehand disclosed therapeutic areas, whereas sustaining our therapeutically agnostic portfolio.”

Viatris CFO Sanjeev Narula stated: “We’re pleased with our strong operational outcomes which exceeded our expectations and included producing roughly $1.8 billion in free money move within the first half of 2022. We additionally retired $1.5 billion in debt throughout the identical interval, which places us effectively on monitor to fulfill our 2022 debt paydown dedication. As we look forward to the remainder of 2022, we stay assured within the operational power of the enterprise. Due to this fact, we’re reaffirming our adjusted EBITDA and free money move steering ranges regardless of overseas trade headwinds. We consider that our capital allocation framework, together with the dedication to the dividend and sustaining the funding grade ranking, will proceed to be a pressure in creating long run worth.”

Monetary Abstract

|

Three Months Ended

|

|||||||

|

June 30,

|

|||||||

|

(Unaudited; in thousands and thousands, besides per share quantities and %s)

|

2022

|

2021

|

Reported Change

|

Operational Change(1)

|

|||

|

Whole Internet Gross sales

|

$ 4,105.4

|

$ 4,561.7

|

(10) %

|

(3) %

|

|||

|

Developed Markets

|

2,479.1

|

2,640.4

|

(6) %

|

1 %

|

|||

|

Rising Markets

|

650.9

|

870.0

|

(25) %

|

(19) %

|

|||

|

JANZ

|

427.1

|

501.0

|

(15) %

|

(2) %

|

|||

|

Better China

|

548.3

|

550.3

|

— %

|

1 %

|

|||

|

Internet Gross sales by Product Class

|

|||||||

|

Manufacturers

|

$ 2,483.1

|

$ 2,701.7

|

(8) %

|

(1) %

|

|||

|

Advanced Gx and Biosimilars

|

354.8

|

332.8

|

7 %

|

11 %

|

|||

|

Generics

|

1,267.5

|

1,527.2

|

(17) %

|

(11) %

|

|||

|

U.S. GAAP Gross Revenue

|

$ 1,703.3

|

$ 1,327.7

|

28 %

|

||||

|

U.S. GAAP Gross Margin

|

41.4 %

|

29.0 %

|

|||||

|

Adjusted Gross Revenue (2)

|

$ 2,411.7

|

$ 2,677.2

|

(10) %

|

||||

|

Adjusted Gross Margin (2)

|

58.6 %

|

58.5 %

|

|||||

|

U.S. GAAP Internet Earnings (Loss)

|

$ 313.9

|

$ (279.2)

|

nm

|

||||

|

Adjusted Internet Earnings (2)

|

$ 1,065.3

|

$ 1,180.6

|

(10) %

|

||||

|

EBITDA (2)

|

$ 1,257.6

|

$ 1,281.8

|

(2) %

|

||||

|

Adjusted EBITDA (2)

|

$ 1,482.1

|

$ 1,675.4

|

(12) %

|

(6) %

|

|||

|

U.S. GAAP web money supplied by working actions

|

$ 802.5

|

$ 559.4

|

43 %

|

||||

|

Capital expenditures

|

83.9

|

89.3

|

(6) %

|

||||

|

Free money move (2)

|

$ 718.6

|

$ 470.1

|

53 %

|

||||

|

Six Months Ended

|

|||||||

|

June 30,

|

|||||||

|

(Unaudited; in thousands and thousands, besides per share quantities and %s)

|

2022

|

2021

|

Reported Change

|

Operational Change(1)

|

|||

|

Whole Internet Gross sales

|

$ 8,283.6

|

$ 8,961.8

|

(8) %

|

(2) %

|

|||

|

Developed Markets

|

4,955.2

|

5,212.0

|

(5) %

|

— %

|

|||

|

Rising Markets

|

1,356.1

|

1,624.7

|

(17) %

|

(10) %

|

|||

|

JANZ

|

850.9

|

982.9

|

(13) %

|

(3) %

|

|||

|

Better China

|

1,121.4

|

1,142.2

|

(2) %

|

(2) %

|

|||

|

Internet Gross sales by Product Class

|

|||||||

|

Manufacturers

|

$ 5,037.2

|

$ 5,426.3

|

(7) %

|

(1) %

|

|||

|

Advanced Gx and Biosimilars

|

745.6

|

661.7

|

13 %

|

16 %

|

|||

|

Generics

|

2,500.8

|

2,873.8

|

(13) %

|

(8) %

|

|||

|

U.S. GAAP Gross Revenue

|

$ 3,474.5

|

$ 2,455.0

|

42 %

|

||||

|

U.S. GAAP Gross Margin

|

41.8 %

|

27.3 %

|

|||||

|

Adjusted Gross Revenue (2)

|

$ 4,905.1

|

$ 5,317.1

|

(8) %

|

||||

|

Adjusted Gross Margin (2)

|

59.0 %

|

59.0 %

|

|||||

|

U.S. GAAP Internet Earnings (Loss)

|

$ 713.1

|

$ (1,316.8)

|

nm

|

||||

|

Adjusted Internet Earnings (2)

|

$ 2,190.6

|

$ 2,297.0

|

(5) %

|

||||

|

EBITDA (2)

|

$ 2,667.2

|

$ 2,449.9

|

9 %

|

||||

|

Adjusted EBITDA (2)

|

$ 3,068.4

|

$ 3,312.0

|

(7) %

|

(3) %

|

|||

|

U.S. GAAP web money supplied by working actions

|

$ 1,941.0

|

$ 1,408.2

|

38 %

|

||||

|

Capital expenditures

|

148.4

|

138.8

|

7 %

|

||||

|

Free money move (2)

|

$ 1,792.6

|

$ 1,269.4

|

41 %

|

||||

|

___________

|

|

|

(1)

|

Represents operational change for web gross sales and adjusted EBITDA which excludes the impacts of overseas foreign money translation. See “Sure Key Phrases” on this launch for extra info.

|

|

(2)

|

Non-GAAP monetary measures. See “Non-GAAP Monetary Measures” for added info.

|

Second Quarter Highlights

- Second quarter 2022 web gross sales totaled $4.1 billion, down 3% on an operational foundation in comparison with Q2 2021 outcomes and carried out higher than expectations, pushed by strong efficiency throughout our segments—Developed Markets, Rising Markets, JANZ (Japan, Australia and New Zealand) and Better China.

- Manufacturers carried out higher than expectations, pushed by merchandise akin to EpiPen®, Norvasc® and Lipitor®.

- Advanced generics and biosimilars carried out largely according to expectations and grew by 11% on an operational foundation in comparison with Q2 2021 outcomes, primarily pushed by our interchangeable Semglee® launch within the U.S. Revenues from the biosimilars portfolio to be contributed to Biocon Biologics totaled roughly $167 million within the quarter.

- Generics, which embody diversified product kinds akin to extended-release oral solids, injectables, transdermals and topicals, carried out higher than expectations pushed by greater North America demand.

- The Firm generated roughly $84 million in new product revenues (as outlined in “Sure Key Phrases” under) within the second quarter (roughly $205 million for the primary half of the yr) primarily pushed by interchangeable Semglee® within the U.S. and is on monitor to attain roughly $600 million in new product revenues in 2022.

- The Firm generated $719 million of free money move within the second quarter ($1.79 billion for the primary half of the yr), primarily pushed by strong U.S. GAAP web money supplied by working actions of $803 million within the quarter ($1.94 billion for the primary half of the yr) and the timing of deliberate capital expenditures.

- Viatris paid quarterly money dividends of twelve cents ($0.12) per share on the Firm’s issued and excellent frequent inventory on March 16, 2022, and June 16, 2022. On Aug. 4, 2022, the Firm’s Board of Administrators declared a quarterly dividend of twelve cents ($0.12) per share on the Firm’s issued and excellent frequent inventory, which can be payable on Sept. 16, 2022, to shareholders of report as of the shut of enterprise on Aug. 24, 2022. The Firm paid down roughly $627 million in debt within the second quarter (roughly $1.5 billion for the primary half of the yr) and continues to focus on roughly $2 billion in debt reimbursement in 2022. The Firm stays dedicated to sustaining its funding grade credit standing.

2022 Monetary Steering

The U.S. greenback has continued to strengthen throughout main currencies that affect the Firm’s condensed consolidated monetary statements. To mirror the Firm’s at present anticipated detrimental affect of overseas trade charges of roughly $800 million, the Firm is revising its 2022 steering vary for complete revenues as set forth above. The Firm is reaffirming its 2022 steering ranges for adjusted EBITDA and free money move because it at present believes that it may soak up the overseas trade fee impacts inside these ranges. The Firm is just not offering forward-looking steering for U.S. GAAP web earnings or a quantitative reconciliation of its 2022 adjusted EBITDA steering to essentially the most straight comparable U.S. GAAP measure, U.S. GAAP web earnings (loss), as a result of it’s unable to foretell with cheap certainty the final word end result of sure vital gadgets, together with integration and acquisition-related bills, restructuring bills, asset impairments, litigation settlements and different contingencies, akin to modifications to contingent consideration and sure different positive aspects or losses, in addition to associated earnings tax accounting, as a result of sure of these things haven’t occurred, are out of the Firm’s management and/or can’t be moderately predicted with out unreasonable effort. These things are unsure, rely on varied elements, and will have a fabric affect on U.S. GAAP reported outcomes for the steering interval.

Convention Name and Earnings Supplies

Viatris Inc. will host a convention name and stay webcast, at this time at 8:30 a.m. ET, to assessment the Firm’s monetary outcomes for the second quarter ended June 30, 2022. Traders and most of the people are invited to hearken to a stay webcast of the decision at investor.viatris.com or by calling 866.342.8591 or 203.518.9713 for worldwide callers (ID#: VTRSQ222). The “Viatris Q2 Earnings Presentation”, which can be referenced in the course of the name, might be discovered at investor.viatris.com. A replay of the webcast additionally can be obtainable on the web site.

Sure Key Phrases

New product gross sales, new product launches or new product revenues seek advice from income from new merchandise launched in 2022 and the carryover affect of latest merchandise, together with enterprise improvement, launched throughout the final twelve months.

Operational change refers to fixed foreign money share change and is derived by translating quantities for the present interval at prior yr comparative interval trade charges, and in doing so exhibits the proportion change from 2022 fixed foreign money web gross sales, revenues and adjusted EBITDA to the corresponding quantity within the prior yr.

Non-GAAP Monetary Measures

This press launch consists of the presentation and dialogue of sure monetary info that differs from what’s reported below accounting ideas typically accepted in america (“U.S. GAAP”). These non-GAAP monetary measures, together with, however not restricted to, adjusted gross revenue, adjusted gross margins, adjusted web earnings, EBITDA, adjusted EBITDA, free money move, adjusted R&D and as a % of complete revenues, adjusted SG&A and as a % of complete revenues, adjusted earnings from operations, adjusted curiosity expense, adjusted different expense (earnings), web, adjusted efficient tax fee, fixed foreign money complete revenues, fixed foreign money web gross sales and fixed foreign money adjusted EBITDA are offered so as to complement traders’ and different readers’ understanding and evaluation of the monetary efficiency of Viatris Inc. (“Viatris” or the “Firm”). Free money move refers to U.S. GAAP web money supplied by working actions, much less capital expenditures. Adjusted EBITDA margin refers to adjusted EBITDA divided by complete revenues. Administration makes use of these measures internally for forecasting, budgeting, measuring its working efficiency, and incentive-based awards. Primarily attributable to acquisitions and different vital occasions which can affect comparability of our periodic working outcomes, Viatris believes that an analysis of its ongoing operations (and comparisons of its present operations with historic and future operations) can be troublesome if the disclosure of its monetary outcomes was restricted to monetary measures ready solely in accordance with U.S. GAAP. We consider that non-GAAP monetary measures are helpful supplemental info for our traders and when thought-about along with our U.S. GAAP monetary measures and the reconciliation to essentially the most straight comparable U.S. GAAP monetary measure, present a extra full understanding of the elements and tendencies affecting our operations. The monetary efficiency of the Firm is measured by senior administration, partly, utilizing adjusted metrics included herein, together with different efficiency metrics. As well as, the Firm believes that together with EBITDA and supplemental changes utilized in presenting adjusted EBITDA is acceptable to offer further info to traders to display the Firm’s skill to adjust to monetary debt covenants and assess the Firm’s skill to incur further indebtedness. The Firm additionally believes that adjusted EBITDA higher focuses administration on the Firm’s underlying operational outcomes and true enterprise efficiency and, is used, partly, for administration’s incentive compensation. We additionally report gross sales efficiency utilizing the non-GAAP monetary measures of “fixed foreign money”, additionally referred to herein as “operational change”, complete revenues, web gross sales and adjusted EBITDA. These measures present info on the change in complete revenues, web gross sales and adjusted EBITDA assuming that overseas foreign money trade charges had not modified between the prior and present interval. The comparisons offered at fixed foreign money charges mirror comparative native foreign money gross sales on the prior yr’s overseas trade charges. We routinely consider our web gross sales, complete revenues and adjusted EBITDA efficiency at fixed foreign money in order that gross sales outcomes might be seen with out the affect of overseas foreign money trade charges, thereby facilitating a period-to-period comparability of our operational actions and consider that this presentation additionally offers helpful info to traders for a similar cause. The “Abstract of Whole Revenues by Phase” desk under compares web gross sales on an precise and fixed foreign money foundation for every reportable section for the quarters and 6 months ended June 30, 2022 and 2021 in addition to for complete revenues. Additionally, set forth under, Viatris has supplied reconciliations of such non-GAAP monetary measures to essentially the most straight comparable U.S. GAAP monetary measures. Traders and different readers are inspired to assessment the associated U.S. GAAP monetary measures and the reconciliations of the non-GAAP measures to their most straight comparable U.S. GAAP measures set forth under, and traders and different readers ought to take into account non-GAAP measures solely as dietary supplements to, not as substitutes for or as superior measures to, the measures of monetary efficiency ready in accordance with U.S. GAAP. For extra info relating to the parts and makes use of of Non-GAAP monetary measures seek advice from Administration’s Dialogue and Evaluation of Monetary Situation and Outcomes of Operations—Use of Non-GAAP Monetary Measures part of Viatris’ Quarterly Report on Kind 10-Q for the three months ended June 30, 2022.

About Viatris

Viatris Inc. (NASDAQ: VTRS) is a world pharmaceutical firm empowering individuals worldwide to stay more healthy at each stage of life. We offer entry to medicines, advance sustainable operations, develop revolutionary options and leverage our collective experience to attach extra individuals to extra services by way of our one-of-a-kind International Healthcare Gateway®. Shaped in November 2020, Viatris brings collectively scientific, manufacturing and distribution experience with confirmed regulatory, medical, and industrial capabilities to ship high-quality medicines to sufferers in additional than 165 international locations and territories. Viatris’ portfolio includes greater than 1,400 accredited molecules throughout a variety of therapeutic areas, spanning each non-communicable and infectious ailments, together with globally acknowledged manufacturers, complicated generic and branded medicines, a portfolio of biosimilars and a wide range of over-the-counter shopper merchandise. With roughly 37,000 colleagues globally, Viatris is headquartered within the U.S., with international facilities in Pittsburgh, Shanghai and Hyderabad, India. Be taught extra at viatris.com and investor.viatris.com, and join with us on Twitter at @ViatrisInc, LinkedIn and YouTube.

Ahead-looking Statements

This launch accommodates “forward-looking statements”. These statements are made pursuant to the secure harbor provisions of the Personal Securities Litigation Reform Act of 1995. Such forward-looking statements might embody, with out limitation, statements about Viatris’ 2022 monetary steering; that Viatris reaffirms adjusted EBITDA and free money move steering ranges regardless of overseas trade headwinds; revises complete revenues steering vary solely to mirror the incremental affect of overseas trade; Biocon Biologics Transaction on monitor for shut in second half of 2022; robust H1 2022 operational efficiency according to expectations, and full yr operationally according to earlier steering; absorbing Fx headwind on adjusted EBITDA and free money move; strong execution, improved COGS, and favorable combine positively impacting gross margins; driving synergies and operational efficiencies proceed to affect SG&A favorably; enhancing money conversion by way of working capital enhancements and decrease capital expenditures; Viatris’ Board of Administrators declared a quarterly dividend of twelve cents ($0.12) for every issued and excellent share of the corporate’s frequent inventory; the dividend is payable on Sept. 16, 2022, to shareholders of report on the shut of enterprise on Aug. 24, 2022; we’re hitting on all cylinders operationally, even whereas overseas trade charges proceed to be difficult, and have now demonstrated six consecutive quarters of robust efficiency; we proceed to ship on our monetary and strategic commitments and are making good progress on all of the reshaping initiatives introduced in February, together with the additional ramp up of our inorganic exercise in our International Healthcare Gateway; we consider our robust and constant operational execution displays the resilience of a diversified enterprise that has been constructed intentionally to make sure we aren’t depending on anyone market or product and permits us to stay agile and opportunistic to carry out persistently throughout all geographies; wanting forward, we’re very excited to construct upon our robust legacy in improvement and leverage our in depth scientific capabilities to proceed transferring up the worth chain; by way of our International Healthcare Gateway, we anticipate to additional strengthen our deep pipeline to develop extra 505(b)(2)s and new chemical entities within the beforehand disclosed therapeutic areas, whereas sustaining our therapeutically agnostic portfolio; we’re pleased with our strong operational outcomes which exceeded our expectations and included producing roughly $1.8 billion in free money move within the first half of 2022; we additionally retired $1.5 billion in debt throughout the identical interval, which places us effectively on monitor to fulfill our 2022 debt paydown dedication; as we look forward to the remainder of 2022, we stay assured within the operational power of the enterprise; we’re reaffirming our adjusted EBITDA and free money move steering ranges regardless of overseas trade headwinds; we consider that our capital allocation framework, together with the dedication to the dividend and sustaining the funding grade ranking, will proceed to be a pressure in creating long run worth; the corporate is on monitor to attain roughly $600 million in new product revenues in 2022; the Firm paid down roughly $627 million in debt within the second quarter (roughly $1.5 billion for the primary half of the yr) and continues to focus on roughly $2 billion in debt reimbursement in 2022; the Firm stays dedicated to sustaining its funding grade credit standing; statements concerning the pending transaction between Viatris and Biocon Biologics Restricted (“Biocon Biologics”) pursuant to which Viatris will contribute its biosimilars portfolio to Biocon Biologics (the “Biocon Biologics Transaction”), statements concerning the transaction pursuant to which Mylan N.V. (“Mylan”) mixed with Pfizer Inc.’s Upjohn enterprise (the “Upjohn Enterprise”) in a Reverse Morris Belief transaction (the “Mixture”) and Upjohn Inc. grew to become the mum or dad entity of the mixed Upjohn Enterprise and Mylan enterprise and was renamed “Viatris Inc.”, the advantages and synergies of the Mixture or our international restructuring program, future alternatives for the Firm and its merchandise and another statements relating to the Firm’s future operations, monetary or working outcomes, capital allocation, dividend coverage and funds, debt ratio and covenants, anticipated enterprise ranges, future earnings, deliberate actions, anticipated development, market alternatives, methods, competitions, commitments, confidence in future outcomes, efforts to create, improve or in any other case unlock the worth of our distinctive international platform, and different expectations and targets for future durations. Ahead-looking statements might typically be recognized by means of phrases akin to “will”, “might”, “may”, “ought to”, “would”, “undertaking”, “consider”, “anticipate”, “anticipate”, “plan”, “estimate”, “forecast”, “potential”, “pipeline”, “intend”, “proceed”, “goal”, “search” and variations of those phrases or comparable phrases. As a result of forward-looking statements inherently contain dangers and uncertainties, precise future outcomes might differ materially from these expressed or implied by such forward-looking statements. Components that might trigger or contribute to such variations embody, however are usually not restricted to: the chance that the Firm could also be unable to attain anticipated advantages, synergies and working efficiencies in reference to the Mixture or its international restructuring program throughout the anticipated timeframe or in any respect; the pending Biocon Biologics Transaction and different strategic initiatives, together with potential divestitures, might not obtain their meant advantages; operational or monetary difficulties or losses related to the Firm’s reliance on agreements with Pfizer in reference to the Mixture, together with with respect to transition providers; the potential affect of public well being outbreaks, epidemics and pandemics, together with the continuing challenges and uncertainties posed by the COVID-19 pandemic; the Firm’s failure to attain anticipated or focused future monetary and working efficiency and outcomes; actions and selections of healthcare and pharmaceutical regulators; modifications in related legal guidelines and laws, together with however not restricted to modifications in tax, healthcare and pharmaceutical legal guidelines and laws globally (together with the affect of potential tax reform within the U.S.); the power to draw and retain key personnel; the Firm’s liquidity, capital assets and skill to acquire financing; any regulatory, authorized or different impediments to the Firm’s skill to convey new merchandise to market, together with however not restricted to “at-risk launches”; success of medical trials and the Firm’s or its companions’ skill to execute on new product alternatives and develop, manufacture and commercialize merchandise; any modifications in or difficulties with the Firm’s manufacturing services, together with with respect to inspections, remediation and restructuring actions, provide chain or stock or the power to fulfill anticipated demand; the scope, timing and end result of any ongoing authorized proceedings, together with authorities inquiries or investigations, and the affect of any such proceedings on the Firm; any vital breach of information safety or knowledge privateness or disruptions to our info expertise programs; dangers related to having vital operations globally; the power to guard mental property and protect mental property rights; modifications in third-party relationships; the impact of any modifications within the Firm’s or its companions’ buyer and provider relationships and buyer buying patterns, together with buyer loss and enterprise disruption being better than anticipated following the Mixture; the impacts of competitors, together with decreases in gross sales or revenues on account of the lack of market exclusivity for sure merchandise; modifications within the financial and monetary situations of the Firm or its companions; uncertainties relating to future demand, pricing and reimbursement for the Firm’s merchandise; uncertainties and issues past the management of administration, together with however not restricted to normal political and financial situations, inflation charges and international trade charges; and inherent uncertainties concerned within the estimates and judgments used within the preparation of monetary statements, and the offering of estimates of monetary measures, in accordance with U.S. GAAP and associated requirements or on an adjusted foundation. For extra detailed info on the dangers and uncertainties related to Viatris, see the dangers described in Half I, Merchandise 1A within the Firm’s Annual Report on Kind 10-Okay for the yr ended December 31, 2021, as amended, and our different filings with the SEC. You’ll be able to entry Viatris’ filings with the SEC by way of the SEC web site at www.sec.gov or by way of our web site, and Viatris strongly encourages you to take action. Viatris routinely posts info that could be essential to traders on our web site at investor.viatris.com, and we use this web site deal with as a way of exposing materials info to the general public in a broad, non-exclusionary method for functions of the SEC’s Regulation Honest Disclosure (Reg FD). The contents of our web site are usually not included into this launch or our different filings with the SEC. Viatris undertakes no obligation to replace any statements herein for revisions or modifications after the date of this launch apart from as required by regulation.

|

Viatris Inc. and Subsidiaries

|

|||||||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

Revenues:

|

|||||||

|

Internet gross sales

|

$ 4,105.4

|

$ 4,561.7

|

$ 8,283.6

|

$ 8,961.8

|

|||

|

Different revenues

|

11.4

|

16.1

|

24.9

|

46.3

|

|||

|

Whole revenues

|

4,116.8

|

4,577.8

|

8,308.5

|

9,008.1

|

|||

|

Price of gross sales

|

2,413.5

|

3,250.1

|

4,834.0

|

6,553.1

|

|||

|

Gross revenue

|

1,703.3

|

1,327.7

|

3,474.5

|

2,455.0

|

|||

|

Working bills:

|

|||||||

|

Analysis and improvement

|

162.6

|

147.7

|

304.9

|

331.8

|

|||

|

Promoting, normal and administrative

|

981.1

|

1,204.8

|

1,896.4

|

2,391.3

|

|||

|

Litigation settlements and different contingencies, web

|

10.9

|

23.0

|

17.1

|

45.9

|

|||

|

Whole working bills

|

1,154.6

|

1,375.5

|

2,218.4

|

2,769.0

|

|||

|

Earnings (loss) from operations

|

548.7

|

(47.8)

|

1,256.1

|

(314.0)

|

|||

|

Curiosity expense

|

145.9

|

167.1

|

292.1

|

336.1

|

|||

|

Different expense, web

|

13.5

|

4.2

|

47.2

|

10.3

|

|||

|

Earnings (loss) earlier than earnings taxes

|

389.3

|

(219.1)

|

916.8

|

(660.4)

|

|||

|

Revenue tax provision

|

75.4

|

60.1

|

203.7

|

656.4

|

|||

|

Internet earnings (loss)

|

313.9

|

(279.2)

|

$ 713.1

|

$ (1,316.8)

|

|||

|

Earnings (loss) per share attributable to Viatris Inc. shareholders

|

|||||||

|

Primary

|

$ 0.26

|

$ (0.23)

|

$ 0.59

|

$ (1.09)

|

|||

|

Diluted

|

$ 0.26

|

$ (0.23)

|

$ 0.59

|

$ (1.09)

|

|||

|

Weighted common shares excellent:

|

|||||||

|

Primary

|

1,212.3

|

1,208.8

|

1,211.4

|

1,208.2

|

|||

|

Diluted

|

1,217.1

|

1,208.8

|

1,215.1

|

1,208.2

|

|||

|

Viatris Inc. and Subsidiaries

|

|||

|

June 30,

|

December 31,

|

||

|

ASSETS

|

|||

|

Belongings

|

|||

|

Present property:

|

|||

|

Money and money equivalents

|

$ 664.7

|

$ 701.2

|

|

|

Accounts receivable, web

|

3,736.2

|

4,266.4

|

|

|

Inventories

|

3,612.5

|

3,977.7

|

|

|

Pay as you go bills and different present property

|

1,697.7

|

1,957.6

|

|

|

Belongings held on the market

|

1,465.4

|

—

|

|

|

Whole present property

|

11,176.5

|

10,902.9

|

|

|

Intangible property, web

|

24,101.1

|

26,134.2

|

|

|

Goodwill

|

10,523.0

|

12,113.7

|

|

|

Different non-current property

|

5,324.5

|

5,692.0

|

|

|

Whole property

|

$ 51,125.1

|

$ 54,842.8

|

|

|

LIABILITIES AND EQUITY

|

|||

|

Liabilities

|

|||

|

Present portion of long-term debt and different long-term obligations

|

$ 768.2

|

$ 1,877.5

|

|

|

Liabilities held on the market

|

285.1

|

—

|

|

|

Different present liabilities

|

6,627.9

|

8,006.9

|

|

|

Lengthy-term debt

|

19,206.4

|

19,717.1

|

|

|

Different non-current liabilities

|

4,432.1

|

4,748.6

|

|

|

Whole liabilities

|

31,319.7

|

34,350.1

|

|

|

Shareholders’ fairness

|

19,805.4

|

20,492.7

|

|

|

Whole liabilities and fairness

|

$ 51,125.1

|

$ 54,842.8

|

|

|

Viatris Inc. and Subsidiaries

|

||||

|

Key Product Internet Gross sales, on a Consolidated Foundation

|

||||

|

(Unaudited)

|

||||

|

Three months ended June 30,

|

Six months ended June 30,

|

|||

|

(In thousands and thousands)

|

2022

|

2021

|

2022

|

2021

|

|

Choose Key International Merchandise

|

||||

|

Lipitor ®

|

$ 405.6

|

$ 398.3

|

$ 845.7

|

$ 862.9

|

|

Norvasc ®

|

203.0

|

209.8

|

410.8

|

437.5

|

|

Lyrica ®

|

155.8

|

192.5

|

327.4

|

380.3

|

|

Viagra ®

|

115.1

|

134.8

|

244.9

|

274.4

|

|

EpiPen® Auto-Injectors

|

106.5

|

104.1

|

195.3

|

207.8

|

|

Celebrex ®

|

85.9

|

82.3

|

171.2

|

171.3

|

|

Creon ®

|

75.4

|

80.7

|

150.1

|

150.6

|

|

Effexor ®

|

73.7

|

83.5

|

151.2

|

160.1

|

|

Zoloft ®

|

62.5

|

70.9

|

135.6

|

147.5

|

|

Xalabrands

|

42.7

|

58.3

|

95.7

|

116.2

|

|

Choose Key Phase Merchandise

|

||||

|

Dymista ®

|

$ 55.5

|

$ 54.6

|

$ 99.4

|

$ 94.9

|

|

Yupelri ®

|

49.1

|

41.8

|

92.7

|

78.7

|

|

Amitiza ®

|

44.1

|

52.1

|

85.9

|

98.0

|

|

Xanax ®

|

37.2

|

48.8

|

77.2

|

93.9

|

|

____________

|

|

|

(a)

|

The Firm doesn’t disclose web gross sales for any merchandise thought-about competitively delicate.

|

|

(b)

|

Merchandise disclosed might change in future durations, together with on account of seasonality, competitors or new product launches.

|

|

(c)

|

Quantities for the three and 6 months ended June 30, 2022 embody the unfavorable affect of overseas foreign money translations in comparison with the prior yr interval.

|

|

Viatris Inc. and Subsidiaries

|

|||||||

|

Reconciliation of U.S. GAAP Internet Earnings (Loss) to Adjusted Internet Earnings

|

|||||||

|

Under is a reconciliation of U.S. GAAP web earnings (loss) to adjusted web earnings for the three and 6 months ended June 30, 2022 in comparison with the prior yr interval:

|

|||||||

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

||||||

|

(In thousands and thousands)

|

2022

|

2021

|

2022

|

2021

|

|||

|

U.S. GAAP web earnings (loss)

|

$ 313.9

|

$ (279.2)

|

$ 713.1

|

$ (1,316.8)

|

|||

|

Buy accounting associated amortization (primarily included in value of gross sales)

|

644.9

|

1,169.8

|

1,303.8

|

2,424.8

|

|||

|

Litigation settlements and different contingencies, web

|

10.9

|

23.0

|

17.1

|

45.9

|

|||

|

Curiosity expense (primarily amortization of premiums and reductions on long run debt)

|

(13.1)

|

(13.4)

|

(26.8)

|

(26.7)

|

|||

|

Clear vitality investments pre-tax loss

|

0.1

|

16.7

|

—

|

34.6

|

|||

|

Acquisition associated prices (primarily included in SG&A) (a)

|

122.4

|

48.4

|

207.1

|

108.2

|

|||

|

Restructuring associated prices (b)

|

10.2

|

254.7

|

27.0

|

570.1

|

|||

|

Share-based compensation expense

|

29.4

|

31.0

|

57.7

|

63.7

|

|||

|

Different particular gadgets included in:

|

|||||||

|

Price of gross sales (c)

|

40.5

|

99.4

|

81.5

|

186.1

|

|||

|

Analysis and improvement expense

|

0.6

|

(6.3)

|

0.9

|

8.4

|

|||

|

Promoting, normal and administrative expense

|

17.0

|

10.2

|

24.4

|

29.5

|

|||

|

Different expense, web

|

(0.4)

|

—

|

(1.9)

|

—

|

|||

|

Tax impact of the above gadgets and different earnings tax associated gadgets (d)

|

(111.1)

|

(173.7)

|

(213.3)

|

169.2

|

|||

|

Adjusted web earnings

|

$ 1,065.3

|

$ 1,180.6

|

$ 2,190.6

|

$ 2,297.0

|

|||

|

____________

|

|

|

Vital gadgets embody the next:

|

|

|

(a)

|

Acquisition associated prices consist primarily of transaction prices together with authorized and consulting charges and integration actions.

|

|

(b)

|

For the three and 6 months ended June 30, 2022, fees embody roughly $6.7 million and $19.8 million, respectively, in value of gross sales and roughly $3.5 million and $7.2 million, respectively, in SG&A.

|

|

(c)

|

For the three and 6 months ended June 30, 2022, fees embody incremental manufacturing variances at crops within the 2020 restructuring program of roughly $16.5 million and $47.8 million, respectively.

|

|

(d)

|

Adjusted for modifications for unsure tax positions and for sure impacts of the Mixture.

|

|

Reconciliation of U.S. GAAP Internet Earnings (Loss) to EBITDA and Adjusted EBITDA

|

|||||||

|

Under is a reconciliation of U.S. GAAP web earnings (loss) to EBITDA and adjusted EBITDA for the three and 6 months ended June 30, 2022 in comparison with the prior yr interval:

|

|||||||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

(In thousands and thousands)

|

2022

|

2021

|

2022

|

2021

|

|||

|

U.S. GAAP web earnings (loss)

|

$ 313.9

|

$ (279.2)

|

$ 713.1

|

$ (1,316.8)

|

|||

|

Add changes:

|

|||||||

|

Internet contribution attributable to fairness methodology investments

|

0.1

|

16.7

|

—

|

34.6

|

|||

|

Revenue tax provision

|

75.4

|

60.1

|

203.7

|

656.4

|

|||

|

Curiosity expense (a)

|

145.9

|

167.1

|

292.1

|

336.1

|

|||

|

Depreciation and amortization (b)

|

722.3

|

1,317.1

|

1,458.3

|

2,739.6

|

|||

|

EBITDA

|

$ 1,257.6

|

$ 1,281.8

|

$ 2,667.2

|

$ 2,449.9

|

|||

|

Add changes:

|

|||||||

|

Share-based compensation expense

|

29.4

|

31.0

|

57.7

|

63.7

|

|||

|

Litigation settlements and different contingencies, web

|

10.9

|

23.0

|

17.1

|

45.9

|

|||

|

Restructuring, acquisition associated and different particular gadgets (c)

|

184.2

|

339.6

|

326.4

|

752.5

|

|||

|

Adjusted EBITDA

|

$ 1,482.1

|

$ 1,675.4

|

$ 3,068.4

|

$ 3,312.0

|

|||

|

____________

|

|

|

(a)

|

Contains amortization of premiums and reductions on long-term debt.

|

|

(b)

|

Contains buy accounting associated amortization.

|

|

(c)

|

See gadgets detailed within the Reconciliation of U.S. GAAP Internet Earnings (Loss) to Adjusted Internet Earnings.

|

|

Abstract of Whole Revenues by Phase

|

|||||||||||

|

Three Months Ended

|

|||||||||||

|

June 30,

|

|||||||||||

|

(In thousands and thousands, besides %s)

|

2022

|

2021

|

% Change

|

2022 Forex Impression (1)

|

2022 Fixed Forex Revenues

|

Fixed Forex % Change (2)

|

|||||

|

Internet gross sales

|

|||||||||||

|

Developed Markets

|

$ 2,479.1

|

$ 2,640.4

|

(6) %

|

$ 181.4

|

$ 2,660.5

|

1 %

|

|||||

|

Better China

|

548.3

|

550.3

|

— %

|

5.4

|

553.7

|

1 %

|

|||||

|

JANZ

|

427.1

|

501.0

|

(15) %

|

64.9

|

491.9

|

(2) %

|

|||||

|

Rising Markets

|

650.9

|

870.0

|

(25) %

|

54.0

|

705.0

|

(19) %

|

|||||

|

Whole web gross sales

|

4,105.4

|

4,561.7

|

(10) %

|

305.7

|

4,411.1

|

(3) %

|

|||||

|

Different revenues (3)

|

11.4

|

16.1

|

(29) %

|

0.8

|

12.2

|

(24) %

|

|||||

|

Consolidated complete revenues (4)

|

$ 4,116.8

|

$ 4,577.8

|

(10) %

|

$ 306.5

|

$ 4,423.3

|

(3) %

|

|||||

|

Six Months Ended

|

|||||||||||

|

June 30,

|

|||||||||||

|

(In thousands and thousands, besides %s)

|

2022

|

2021

|

% Change

|

2022 Forex Impression (1)

|

2022 Fixed Forex Revenues

|

Fixed Forex % Change (2)

|

|||||

|

Internet gross sales

|

|||||||||||

|

Developed Markets

|

$ 4,955.2

|

$ 5,212.0

|

(5) %

|

$ 270.5

|

$ 5,225.8

|

— %

|

|||||

|

Better China

|

1,121.4

|

1,142.2

|

(2) %

|

(2.7)

|

1,118.7

|

(2) %

|

|||||

|

JANZ

|

850.9

|

982.9

|

(13) %

|

102.7

|

953.5

|

(3) %

|

|||||

|

Rising Markets

|

1,356.1

|

1,624.7

|

(17) %

|

105.5

|

1,461.6

|

(10) %

|

|||||

|

Whole web gross sales

|

$ 8,283.6

|

$ 8,961.8

|

(8) %

|

$ 476.0

|

$ 8,759.6

|

(2) %

|

|||||

|

Different revenues (3)

|

24.9

|

46.3

|

(46) %

|

1.3

|

26.2

|

(43) %

|

|||||

|

Consolidated complete revenues (4)

|

$ 8,308.5

|

$ 9,008.1

|

(8) %

|

$ 477.3

|

$ 8,785.8

|

(2) %

|

|||||

|

____________

|

|

|

(1)

|

Forex affect is proven as unfavorable (favorable).

|

|

(2)

|

The fixed foreign money share change is derived by translating web gross sales or revenues for the present interval at prior yr comparative interval trade charges, and in doing so exhibits the proportion change from 2022 fixed foreign money web gross sales or revenues to the corresponding quantity within the prior yr.

|

|

(3)

|

For the three months ended June 30, 2022, different revenues in Developed Markets and Rising Markets have been roughly $4.8 million and $6.6 million, respectively. For the six months ended June 30, 2022, different revenues in Developed Markets, JANZ, and Rising Markets have been roughly $11.1 million, $0.9 million, and $12.9 million, respectively.

|

|

(4)

|

Quantities exclude intersegment income which eliminates on a consolidated foundation.

|

|

Reconciliation of Revenue Assertion Line Objects

|

|||||||

|

(Unaudited; in thousands and thousands, besides %s)

|

|||||||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

U.S. GAAP value of gross sales

|

$ 2,413.5

|

$ 3,250.1

|

$ 4,834.0

|

$ 6,553.1

|

|||

|

Deduct:

|

|||||||

|

Buy accounting associated amortization

|

(644.9)

|

(1,169.8)

|

(1,303.7)

|

(2,424.8)

|

|||

|

Acquisition associated gadgets

|

(15.8)

|

(1.0)

|

(24.8)

|

(3.5)

|

|||

|

Restructuring associated prices

|

(6.7)

|

(78.7)

|

(19.8)

|

(246.5)

|

|||

|

Share-based compensation expense

|

(0.5)

|

(0.6)

|

(0.8)

|

(1.2)

|

|||

|

Different particular gadgets

|

(40.5)

|

(99.4)

|

(81.5)

|

(186.1)

|

|||

|

Adjusted value of gross sales

|

$ 1,705.1

|

$ 1,900.6

|

$ 3,403.4

|

$ 3,691.0

|

|||

|

Adjusted gross revenue (a)

|

$ 2,411.7

|

$ 2,677.2

|

$ 4,905.1

|

$ 5,317.1

|

|||

|

Adjusted gross margin (a)

|

59 %

|

58 %

|

59 %

|

59 %

|

|||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

U.S. GAAP R&D

|

$ 162.6

|

$ 147.7

|

$ 304.9

|

$ 331.8

|

|||

|

Add / (Deduct):

|

|||||||

|

Acquisition associated prices

|

(1.7)

|

(0.2)

|

(3.7)

|

(0.3)

|

|||

|

Restructuring and associated prices

|

—

|

(10.2)

|

—

|

(16.6)

|

|||

|

Share-based compensation expense

|

(1.6)

|

(0.8)

|

(3.0)

|

(1.9)

|

|||

|

Different particular gadgets (b)

|

(0.6)

|

6.3

|

(0.9)

|

(8.4)

|

|||

|

Adjusted R&D

|

$ 158.7

|

$ 142.8

|

$ 297.3

|

$ 304.6

|

|||

|

Adjusted R&D as % of complete revenues

|

4 %

|

3 %

|

4 %

|

3 %

|

|||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

U.S. GAAP SG&A

|

$ 981.1

|

$ 1,204.8

|

$ 1,896.4

|

$ 2,391.3

|

|||

|

Deduct:

|

|||||||

|

Acquisition associated prices

|

(104.7)

|

(47.2)

|

(178.5)

|

(104.4)

|

|||

|

Restructuring and associated prices

|

(3.5)

|

(165.8)

|

(7.2)

|

(307.0)

|

|||

|

Buy accounting amortization and different associated gadgets

|

—

|

—

|

(0.1)

|

—

|

|||

|

Share-based compensation expense

|

(27.5)

|

(29.5)

|

(54.0)

|

(60.5)

|

|||

|

Different particular gadgets and reclassifications

|

(17.0)

|

(10.2)

|

(24.4)

|

(29.5)

|

|||

|

Adjusted SG&A

|

$ 828.4

|

$ 952.1

|

$ 1,632.2

|

$ 1,889.9

|

|||

|

Adjusted SG&A as % of complete revenues

|

20 %

|

21 %

|

20 %

|

21 %

|

|||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

U.S. GAAP complete working bills

|

$ 1,154.6

|

$ 1,375.5

|

$ 2,218.4

|

$ 2,769.0

|

|||

|

Deduct:

|

|||||||

|

Litigation settlements and different contingencies, web

|

(10.9)

|

(23.0)

|

(17.1)

|

(45.9)

|

|||

|

R&D changes

|

(3.9)

|

(4.9)

|

(7.6)

|

(27.2)

|

|||

|

SG&A changes

|

(152.7)

|

(252.7)

|

(264.2)

|

(501.4)

|

|||

|

Adjusted complete working bills

|

$ 987.1

|

$ 1,094.9

|

$ 1,929.5

|

$ 2,194.5

|

|||

|

Adjusted earnings from operations (c)

|

$ 1,424.6

|

$ 1,582.3

|

$ 2,975.6

|

$ 3,122.6

|

|||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

U.S. GAAP curiosity expense

|

$ 145.9

|

$ 167.1

|

$ 292.1

|

$ 336.1

|

|||

|

Add / (Deduct):

|

|||||||

|

Curiosity expense associated to wash vitality investments

|

—

|

(0.3)

|

—

|

(0.3)

|

|||

|

Accretion of contingent consideration legal responsibility

|

(1.8)

|

—

|

(3.8)

|

—

|

|||

|

Amortization of premiums and reductions on long-term debt

|

16.1

|

16.5

|

32.9

|

32.5

|

|||

|

Different particular gadgets

|

(1.1)

|

(2.7)

|

(2.2)

|

(5.4)

|

|||

|

Adjusted curiosity expense

|

$ 159.1

|

$ 180.6

|

$ 319.0

|

$ 362.9

|

|||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

U.S. GAAP different expense, web

|

$ 13.5

|

$ 4.2

|

$ 47.2

|

$ 10.3

|

|||

|

Add / (Deduct):

|

|||||||

|

Clear vitality investments pre-tax loss (d)

|

(0.1)

|

(16.7)

|

—

|

(34.6)

|

|||

|

Different gadgets

|

0.4

|

—

|

1.9

|

—

|

|||

|

Adjusted different expense (earnings), web

|

$ 13.8

|

$ (12.5)

|

$ 49.1

|

$ (24.3)

|

|||

|

Three Months Ended

|

Six Months Ended

|

||||||

|

June 30,

|

June 30,

|

||||||

|

2022

|

2021

|

2022

|

2021

|

||||

|

U.S. GAAP earnings (loss) earlier than earnings taxes

|

$ 389.3

|

$ (219.1)

|

$ 916.8

|

$ (660.4)

|

|||

|

Whole pre-tax non-GAAP changes

|

862.5

|

1,633.4

|

1,690.8

|

3,444.5

|

|||

|

Adjusted earnings earlier than earnings taxes

|

$ 1,251.8

|

$ 1,414.3

|

$ 2,607.6

|

$ 2,784.1

|

|||

|

U.S. GAAP earnings tax provision

|

$ 75.4

|

$ 60.1

|

$ 203.7

|

$ 656.4

|

|||

|

Adjusted tax expense (profit)

|

111.1

|

173.7

|

213.3

|

(169.2)

|

|||

|

Adjusted earnings tax provision

|

$ 186.5

|

$ 233.8

|

$ 417.0

|

$ 487.2

|

|||

|

Adjusted efficient tax fee

|

14.9 %

|

16.5 %

|

16.0 %

|

17.5 %

|

|||

|

___________

|

|

|

(a)

|

U.S. GAAP gross revenue is calculated as complete revenues much less U.S. GAAP value of gross sales. U.S. GAAP gross margin is calculated as U.S. GAAP gross revenue divided by complete revenues. Adjusted gross revenue is calculated as complete revenues much less adjusted value of gross sales. Adjusted gross margin is calculated as adjusted gross revenue divided by complete revenues.

|

|

(b)

|

Starting in 2022, upfront and milestone-related R&D bills associated to collaboration and licensing preparations are not excluded from adjusted web earnings and adjusted EBITDA. This modification had no affect on the three and 6 months ended June 30, 2022. For all prior durations offered, these bills and funds have been excluded from adjusted web earnings and adjusted EBITDA. Prior interval adjusted web earnings and adjusted EBITDA haven’t been recast to mirror this alteration in coverage as a result of the excluded quantity was earnings of roughly $6.3 million and $5.8 million for the three and 6 months ended June 30, 2021, respectively, and is taken into account immaterial.

|

|

(c)

|

U.S. GAAP earnings from operations is calculated as U.S. GAAP gross revenue much less U.S. GAAP complete working bills. Adjusted earnings from operations is calculated as adjusted gross revenue much less adjusted complete working bills.

|

|

(d)

|

Adjustment represents exclusion of exercise associated to Viatris’ clear vitality investments, the actions of which qualify for earnings tax credit below part 45 of the U.S. Inside Income Code of 1986, as amended.

|

|

Reconciliation of Estimated 2022 U.S. GAAP Internet Money Supplied by Working Actions to Free Money Circulation

|

||

|

A reconciliation of the estimated 2022 U. S. GAAP Internet Money supplied by Working Actions to Free Money Circulation is offered under:

|

||

|

Earlier Steering

|

Present Steering

|

|

|

Estimated U. S. GAAP Internet Money supplied by Working Actions

|

$3,200 – $3,400

|

$3,100 – $3,300

|

|

Much less: Capital Expenditures

|

$(525) – $(675)

|

$(425) – $(575)

|

|

Free Money Circulation

|

$2,500 – $2,900

|

$2,500 – $2,900

|

SOURCE Viatris Inc.

For additional info: MEDIA, +1.724.514.1968, [email protected]; Jennifer Mauer, [email protected]; Matt Klein, [email protected]; INVESTORS, Invoice Szablewski, +1.724.514.1813, [email protected], [email protected]