Maxiphoto

Viatris (NASDAQ:VTRS) began buying and selling publicly through a spinoff-merger. Ever since, the inventory has been underperforming resulting from promoting stress. Whereas the herd is working away, alternatives come up for worth traders. As well as, the inventory is tremendously undervalued in comparison with friends. Buyers that make investments with a margin of security ought to take into account Viatris because it affords a lovely dividend yield of 4.8%. Extra so, the agency is contemplating a buyback program after the biosimilars asset sale. Free money stream stays sturdy to assist shareholder returns and reinvestments.

Spinoff – Merger

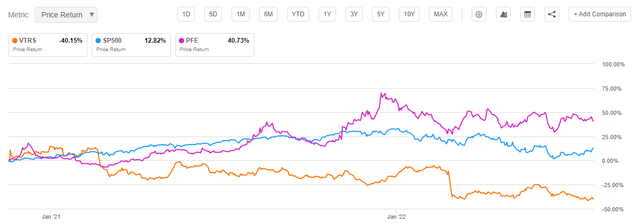

In November 2020, Viatris was fashioned by way of a merger of Mylan and Upjohn (a division of Pfizer (PFE)). Though Pfizer shareholders obtained shares of Viatris, plenty of them offered their shares as quickly as they bought them. For instance, institutional traders of enormous cap funds offered shares of Viatris, as they had been obligated to promote their shares since Viatris is a mid cap inventory. Consequently, the promoting stress began hammering down the inventory as soon as Viatris began buying and selling on the Nasdaq. The inventory is now down 40% from November 2020 as traders are nonetheless clueless about what to do.

Viatris inventory efficiency (Searching for Alpha)

Worth traders like to do the other of the herd. Subsequently, Viatris is likely to be an amazing instance as there are numerous issues to love. Chris Davis, a identified worth investor, has been rising his Viatris place in direction of a 3-3.5% weighting within the Davis New York Enterprise Fund. The fund has been barely outperforming the S&P 500 within the final 40 years with a 12.16% annual return.

Sturdy free money stream permits excessive dividend yield

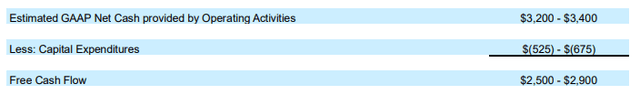

In Q1 2022, Viatris reported $1.07 billion of free money stream. This was primarily pushed by sturdy working actions and the timing of capital expenditures. For the total yr 2022, the corporate expects free money stream to be between $2.5-$2.9 billion. Alternatively, the dividend fee is estimated to be round $580.4 million for the yr (excluding a potential dividend improve).

This outcomes right into a 23% payout ratio of free money stream for the bear case, giving the agency loads of room to payback debt and reinvest into the enterprise. Accordingly, the 4.8% dividend yield is comparatively protected and already offers traders an amazing return on their funding.

FCF estimates 2022 (Earnings Report Q1)

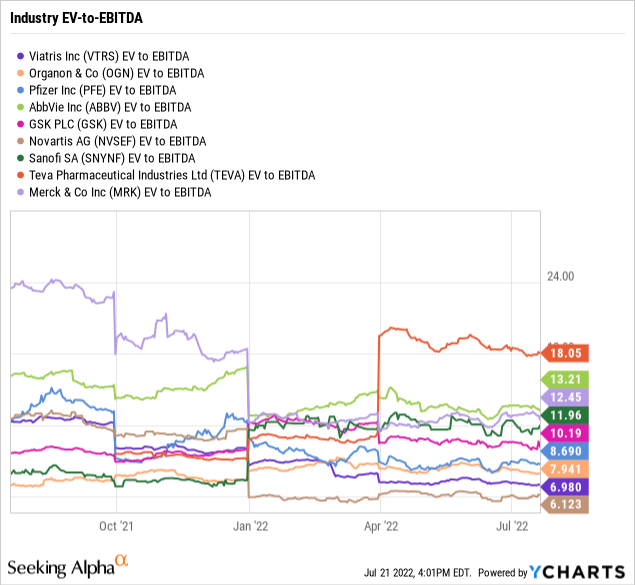

Engaging valuation in comparison with friends

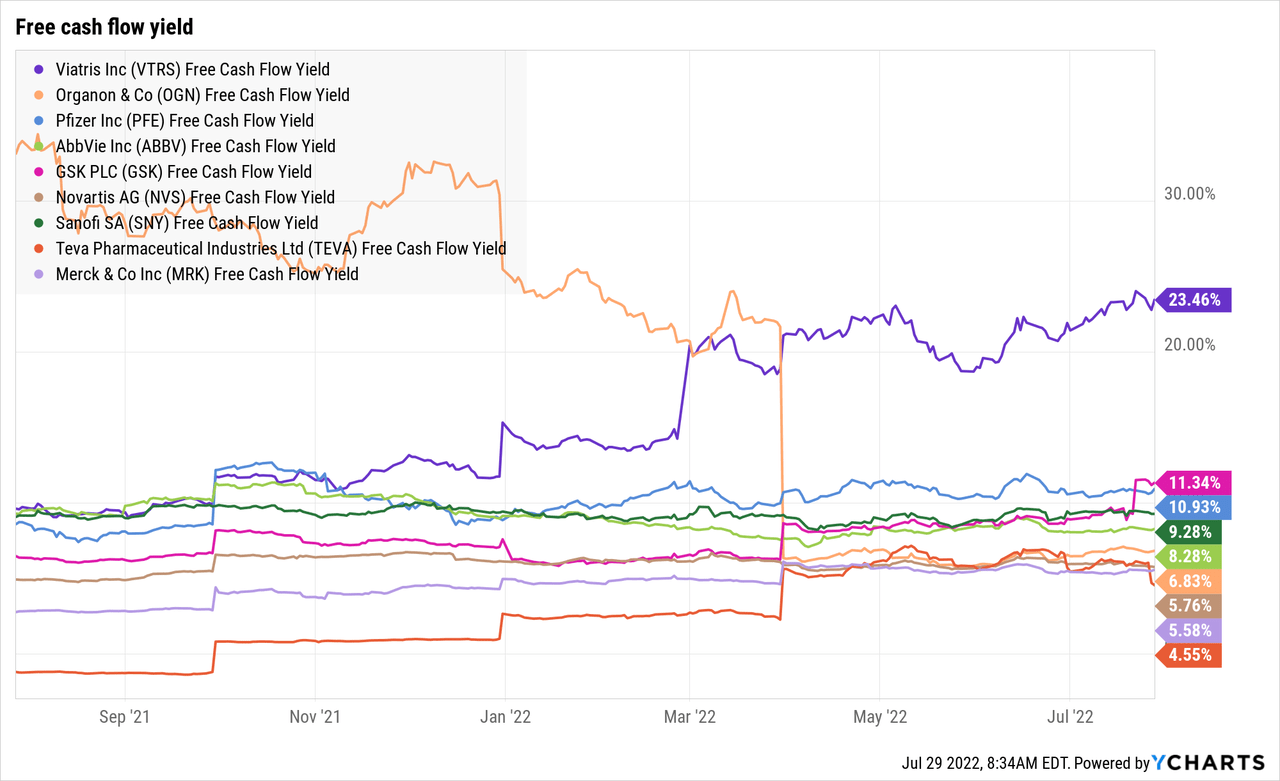

Within the graphs under, I’ve in contrast rivals and friends of Viatris by way of EV to EBITDA and free money stream yield. EV to EBITDA offers us a basic perception of how wholesome a inventory is. The businesses that stand out probably the most are Viatris and Novartis (NVS), as each commerce effectively under the trade common.

Since EV to EBITDA doesn’t embody capital expenditures you will need to deliver free money stream to the desk. Capital expenditures can chew within the complete free money stream of an organization and might lower the potential funds for R&D or acquisitions. Viatris has by far probably the most engaging free money stream yield and it’s not even shut. In consequence, the agency has rather more room to reinvest within the enterprise, pay down debt, pay out dividends and do share buybacks.

Restructuring opens up huge buyback potential

To start with of 2022, Viatris introduced a sale of their biosimilars portfolio to Biocon Biologics. The sale grants Viatris $2 billion in upfront money, $1 billion of convertible most well-liked fairness representing a stake of not less than 12.9% in Biocon Biologics and as much as $335 million of extra funds. Though the property had been offered at 16,5 occasions EBITDA, traders took the information extraordinarily detrimental as this might probably destroy the expansion for the corporate.

However let’s not overlook this firm had a latest merger. Subsequently, crucial issue should be synergy between the 2 firms, which may solely be created when there’s a convergent focus. Moreover, it frees up R&D, capital for reinvestments and share repurchases.

There are 4 standards’s Viatris is at the moment specializing in, because the CEO Rajiv Malik talked about on the Goldman Sachs forty third annual world healthcare convention:

Can we unlock a lure worth? Can we unlock the capital? Can we simplify the Firm? And do now we have property that are maybe higher within the arms of one other focus participant than one of many property in our hand?

To offset the lower in development by the biosimilar sale, the agency can be wanting in direction of a gradual and diligent improve in R&D investments.

Additional, buybacks are very possible because the CFO Sanjeev Narula talked about on the convention:

The proceeds that we’ll get $4 billion web of tax and web of that pay down from these divested property will present us sufficient hearth energy for share buyback, extra BD — develop BD and investing organically within the Firm.

A $1 billion share buyback plan would create 8.5% shareholder worth. Mix this with the dividend yield of virtually 5% and the chance reward steadiness appears to be like very favorable in these unsure occasions.

Dangers

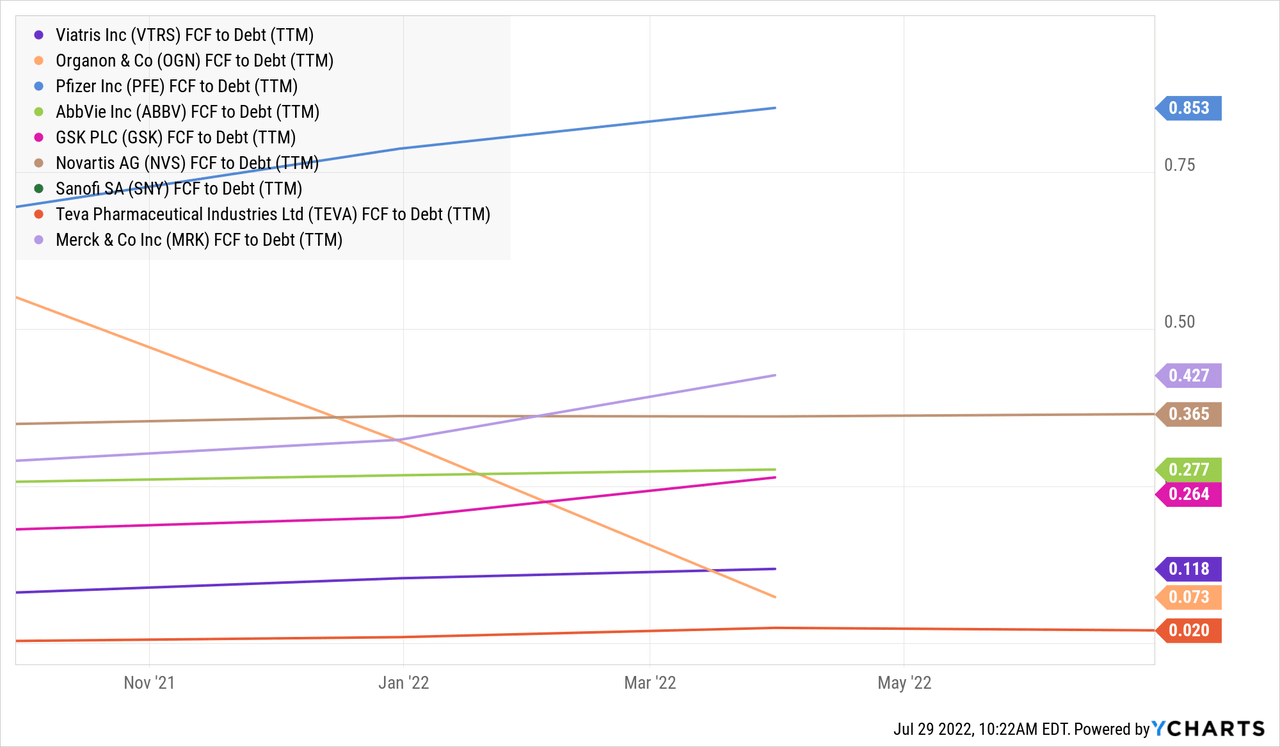

The 2 dangers which can be essential to regulate are the excessive degree of debt and a potential lower in free money stream.

Being leveraged can amplify returns on investments and improve shopping for energy, however an excessive amount of leverage can create dangerous environments. Presently, Viatris is extremely leveraged in comparison with their free money stream, nonetheless the agency is proactively reducing debt. For 2022, Viatris is on observe to pay down $2 billion of debt.

A lower in free money stream might sink Viatris’s inventory deeper down. Even so, one time prices from the merger are coming down, SG&A expense are reducing and synergies between the 2 firms might maybe improve free money stream. The anticipated spending improve on R&D must also be favorable for the corporate because the CEO talked about on the convention:

In case you have tracked us for the final 4 or 5 years or six years, that’s what now we have been spending, $600 million, $700 million in R&D and now we have been getting $600 million, $700 million in annual launches. So, it’s a fairly good 1:1 payback for those who spend over there.

Takeaway

I fee Viatris a Sturdy Purchase under $10 per share. The danger reward steadiness is favorable for long-term traders. The dividend yield and the undervaluation are too engaging to disregard. Wanting on the excessive free money stream yield and EV to EBTIDA ratio, few friends are even near Viatris. Moreover, The administration group is conscious of the dangers and is proactively protecting them at bay. Lastly, a buyback program can enhance the inventory worth right into a constructive momentum setting.