blackCAT/E+ by way of Getty Pictures

Organon (NYSE:OGN) is a number one pharmaceutical firm within the growth and commercialization of medicines for the remedy of ladies’s illnesses. Whereas Viatris (NASDAQ:VTRS), shaped from the merger of Mylan with Upjohn, is a international healthcare firm targeted totally on generics and biosimilars. Each firms have an intensive portfolio of authorized medicines, higher-than-average dividend yields for the pharmaceutical trade, and excessive revenues. Nevertheless, regardless of this, one in every of these firms is extra promising in the long run attributable to a simpler enterprise growth technique and a diversified pipeline of product candidates, which improve the probability of a 50% improve in capitalization relative to the second asset.

Monetary place of Viatris vs. Organon

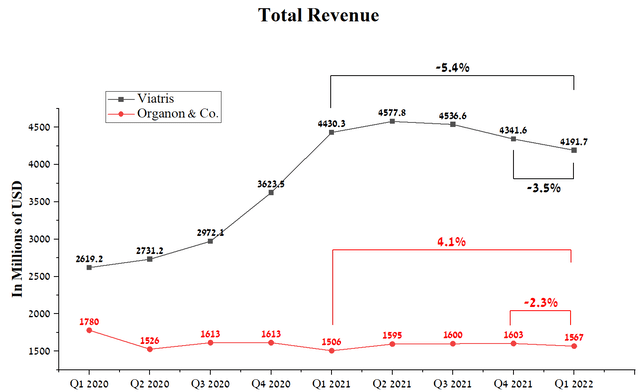

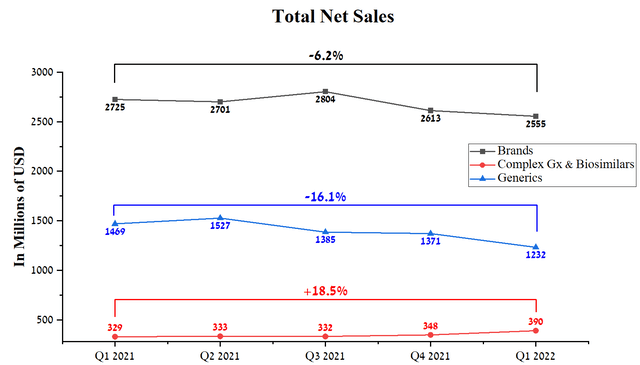

Viatris’ income was $4191.7 million in Q1 2022, down 5.4% year-on-year. On the identical time, Organon & Co. confirmed the alternative dynamics, which earned $1,567 million in Q1 2022, up 4.1% in comparison with Q1 2021.

Supply: Creator’s elaboration, primarily based on Looking for Alpha

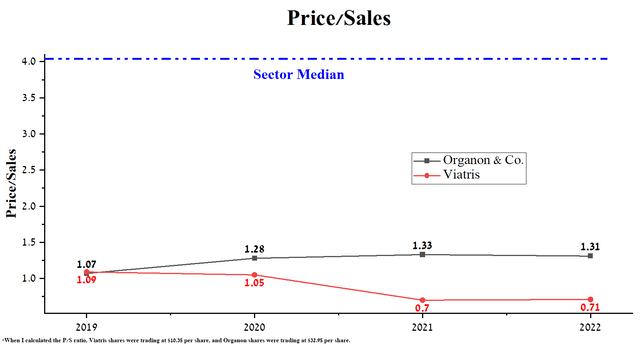

It needs to be famous that the Value / Gross sales ratio of each firms is considerably decrease than that of the pharmaceutical trade, which signifies that they’re underestimated by Wall Avenue. At the moment, Viatris has a ratio of 0.71, which is 45.8% decrease than Organon, displaying that Viatris is an much more undervalued asset within the trade.

Supply: Creator’s elaboration, primarily based on Looking for Alpha

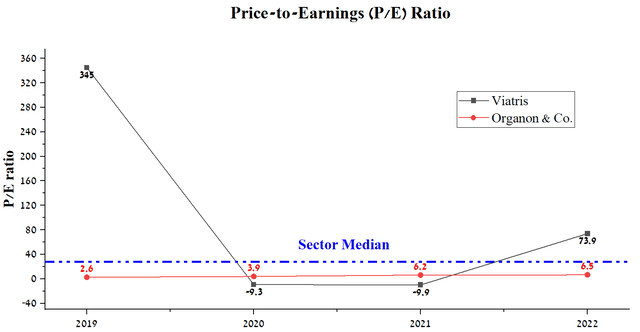

One other essential monetary indicator is the P/E ratio, which exhibits the variety of years that it’ll take for the gathered internet revenue to equal the price of investments. This ratio has a easy dynamic of change for Organon and was 6.5 on the finish of Q1 2022, which is considerably decrease than the trade common. Nevertheless, Viatris is performing worse, with a damaging internet earnings from 2020 to 2021, primarily attributable to elevated capital expenditures and the necessity to pay curiosity on senior notes.

Supply: Creator’s elaboration, primarily based on Looking for Alpha

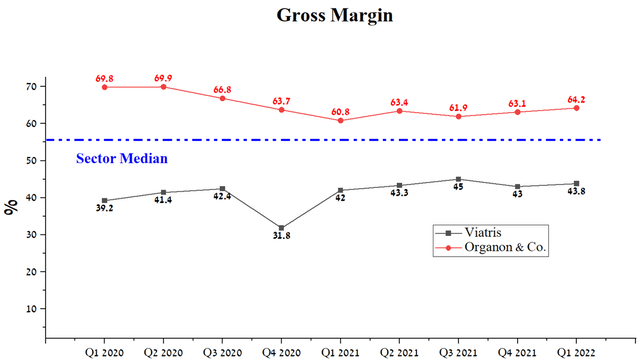

The gross margin of each firms is at a comparatively excessive stage. Nevertheless, because of its continued management within the growth of medicines for the remedy of ladies’s illnesses and favorable tendencies within the sale of biosimilars, Organon has a considerably bigger gross margin, which is 64.2%.

Supply: Creator’s elaboration, primarily based on Looking for Alpha

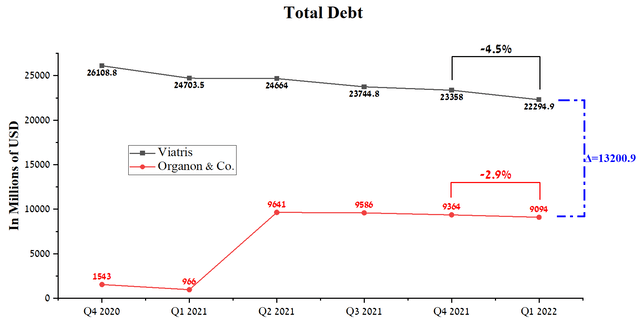

Whereas Viatris’ EBITDA margin is 43.8% on the finish of Q1 2022, which is decrease than Organon’s, and there’s no progress in bettering it in comparison with earlier quarters. In my estimation, that is primarily because of the important share of generic variations of medication or patent medicine whose patents have expired from the corporate’s whole income. Given the truth that Viatris faces competitors from different pharmaceutical firms, the corporate’s administration has to cut back drug costs with a purpose to stay aggressive. Thus, because of the preservation of the quantity of bills and the lower in income, this results in a scarcity of progress in bettering the marginality of the corporate’s enterprise and, as well as, will increase the dangers related to debt servicing. Viatris’ whole debt is $22,294.9 million on the finish of Q1 2022, down 4.5% QoQ. Whereas Organon’s whole debt is $9094 million, down 2.9% from This fall 2021. On the identical time, the distinction in whole debt between the 2 firms is about $13.2 billion, which will increase Organon’s funding attractiveness attributable to decrease dangers and losses in internet earnings, a part of which is used to pay curiosity on bonds.

Supply: Creator’s elaboration, primarily based on Looking for Alpha

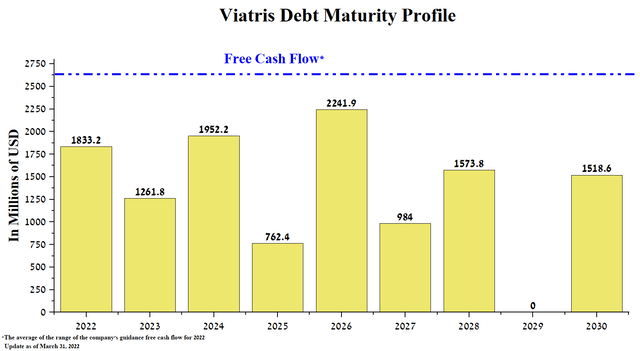

After Upjohn’s spin-off from Pfizer and its merger with Mylan, what gave the impression to be Viatris’ coverage of issuing senior notes wanted to fund its operations was seemingly justified. Nevertheless, funds on them make up a big share of free money move, which, within the face of declining income, will almost definitely result in a lower in dividend funds or a discount in R&D spending, which is a essential situation for the event of the pharmaceutical enterprise.

Supply: Creator’s elaboration, primarily based on 10-Q

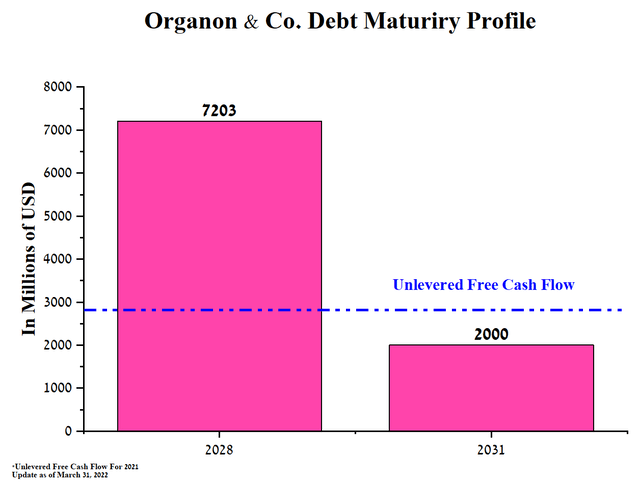

Redemptions of Organon’s senior notes will happen solely in 2028 and 2031, which contributes to a extra versatile monetary coverage by the corporate’s administration, in accordance with which a sure share of free money move is allotted to early debt compensation.

Supply: Creator’s elaboration, primarily based on 10-Q

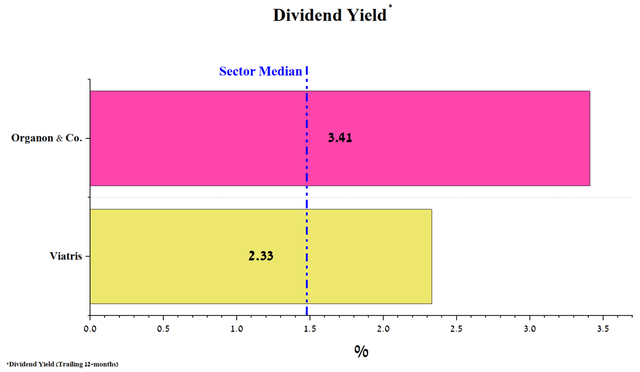

Viatris’ dividend yield is 2.33%, which is beneath Organon’s 3.41% dividend yield. It needs to be famous that this indicator is larger for each firms than the typical worth for the pharmaceutical trade, which is about 1.49%, thereby creating conditions for rising funding curiosity amongst institutional traders with a long-term technique.

Supply: Creator’s elaboration, primarily based on Looking for Alpha

Comparability of a portfolio of authorized medicines

Each firms are leaders within the commercialization and growth of generic variations of medicines or biosimilars and, to a lesser extent, have patent medicines of their portfolios. This a part of the article will analyze the important thing divisions of Viatris and Organon, which herald billions of {dollars} in income per 12 months.

Viatris

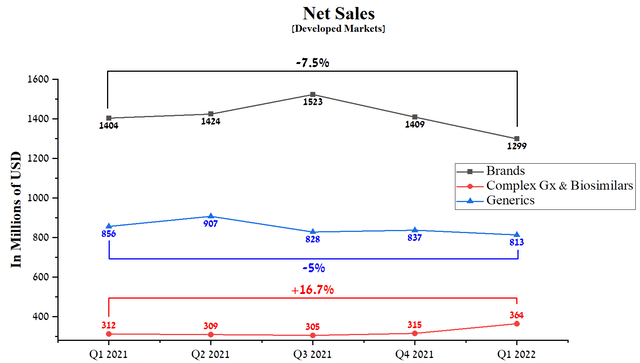

Viatris is likely one of the largest drug suppliers in North America and Europe. Regardless of the main positions, the gross sales of medicines in developed international locations, apart from biosimilars, are declining. It needs to be famous that there’s a tendency to cut back income from quarter to quarter, which, given their sale in high-margin markets, alerts that the Viatris enterprise mannequin isn’t working successfully.

Supply: Creator’s elaboration, primarily based on quarterly securities experiences

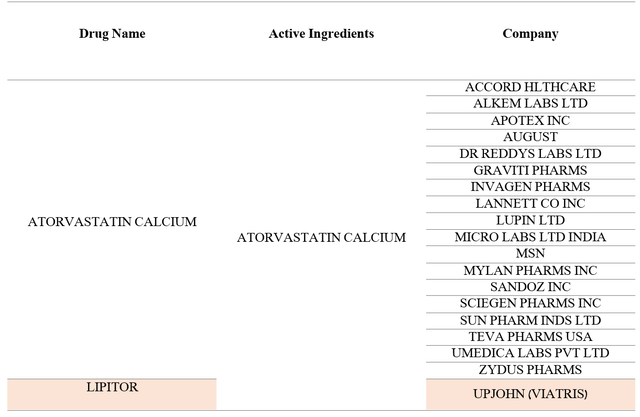

I imagine that the principle purpose for that is Pfizer’s (NYSE:PFE) need to exchange the portfolio of former medicine that have been managed by Upjohn with new medicines that may regain their share in varied therapeutic areas. As well as, different giant pharmaceutical firms are creating medicines which have optimistic cost-effectiveness within the remedy of varied illnesses. Because of this, physicians are attempting to prescribe extra fashionable medicine that justify the excessive worth attributable to their skill to considerably enhance the standard of lifetime of sufferers relative to cheaper generics. As well as, the lower in Viatris’ income can be related to elevated competitors from different generic producers, which have comparatively low manufacturing prices and thus can pursue a extra versatile pricing coverage. So, for instance, take Viatris’ best-selling patent drug, specifically Lipitor (atorvastatin calcium), which is a statin for reducing triglyceride and low-density lipoprotein ranges within the blood and rising HDL, thereby with the ability to cut back the danger of heart problems. Peak gross sales of this medication have been $12.9 billion in 2006, however attributable to patent expiration, income fell to $1.66 billion in 2021. In the intervening time, about 18 pharmaceutical firms produce generic variations of Lipitor, which creates huge challenges for Viatris.

Supply: Creator’s elaboration, primarily based on FDA

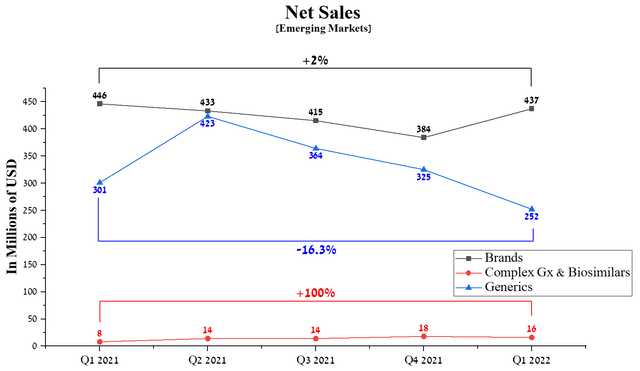

Nevertheless, regardless of the challenges, Viatris has continued to launch new medicine over the previous two years, together with a generic model of Biogen’s (NASDAQ:BIIB) flagship drug, TECFIDERA (dimethyl fumarate), which is used to deal with a number of sclerosis. Rising market income, which incorporates about 82 international locations, introduced in $705 million in Q1 2022. Many of those international locations are extra targeted on the corporate’s branded medicine, which reduces demand for Viatris’ generic portfolio. Because of this, branded medication gross sales totaled $437 million, up 2% year-on-year. Nevertheless, generics proceed to indicate unsatisfactory gross sales figures, which amounted to solely $252 million.

Supply: Creator’s elaboration, primarily based on quarterly securities experiences

Even supposing the corporate strives to launch new medicine, nevertheless, solely the portfolio of biosimilars, whose share of whole income is extraordinarily small, exhibits optimistic gross sales dynamics. Gross sales of the corporate’s generic merchandise proceed to stagnate, disappointing many traders.

Supply: Creator’s elaboration, primarily based on quarterly securities experiences

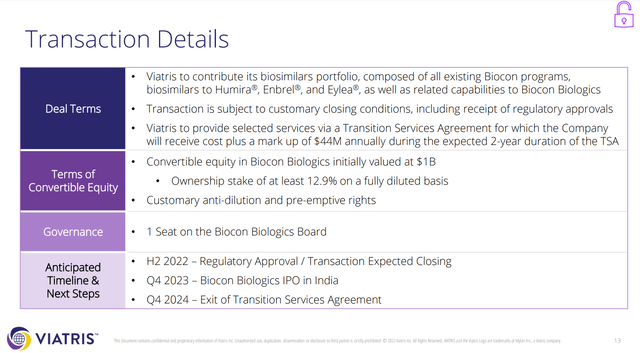

Regardless of the rising biosimilar enterprise, Viatris administration bought it to Biocon Biologics on the finish of February 2022 for $3.335 billion.

Supply: Investor Occasion Presentation

For my part, the corporate’s administration made a mistake, as different Viatris merchandise have decrease margins, and their gross sales are declining. As well as, the corporate is not going to have a share in future gross sales of biosimilars, which limits the variety of sources of income, which is extraordinarily essential within the circumstances of excessive leverage of Viatris.

Organon

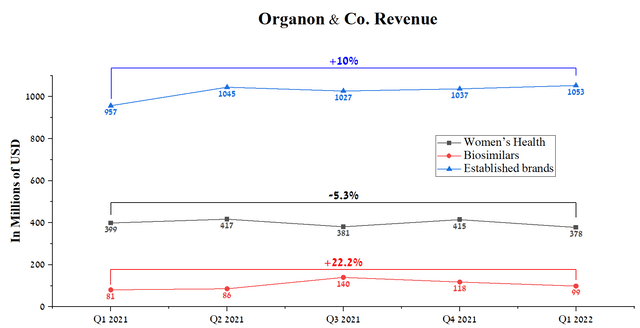

Organon has over sixty medicines and merchandise which are commercialized in 140 international locations world wide. Biosimilars and established manufacturers portfolio gross sales proceed to develop 12 months on 12 months, whereas ladies’s well being portfolio income exhibits a smoother pattern.

Creator’s elaboration, primarily based on quarterly securities experiences

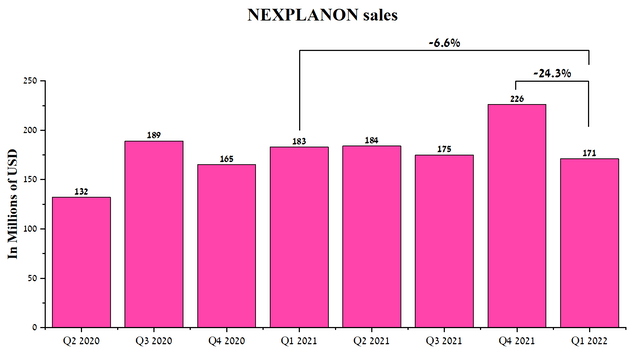

Gross sales of Nexplanon (etonogestrel implant), one in every of Organon’s top-selling contraception drugs, have been $171 million, down 6.6% from the earlier 12 months. This was primarily attributable to decrease demand in america, however this decline was partially offset by larger worldwide gross sales of $55 million, up 31% year-over-year.

Creator’s elaboration, primarily based on quarterly securities experiences

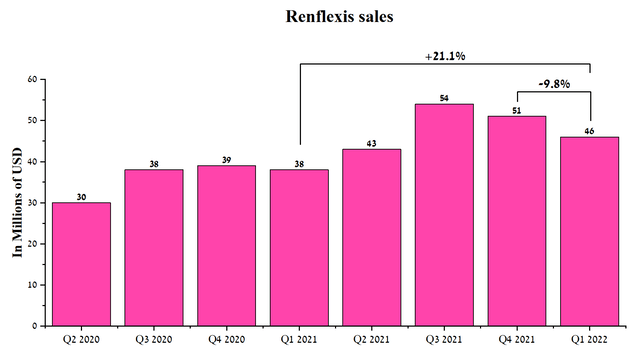

Nevertheless, because of Organon’s diversified portfolio, the double-digit income progress continues to function biosimilar merchandise. That is primarily attributable to elevated demand for Renflexis, which is a biosimilar of Johnson & Johnson’s (NYSE:JNJ) patent drug and is used to deal with autoimmune illnesses.

Creator’s elaboration, primarily based on quarterly securities experiences

For my part, gross sales of biosimilars will proceed to develop attributable to Organon sustaining its main place on this market, increasing the geography of utility, and launching new medicines within the subsequent 5 years. Thus, evaluating the Viatris drug portfolio with Organon, in my view, the Organon portfolio appears to be like extra enticing. The explanations for this are a extra diversified portfolio, and the presence of each patented medicines and biosimilars, whereas Viatris has solely generics or medicine whose patents have expired. Because of this, this results in the dearth of aggressive benefit for Viatris relative to different pharmaceutical firms, which can negatively have an effect on income progress sooner or later.

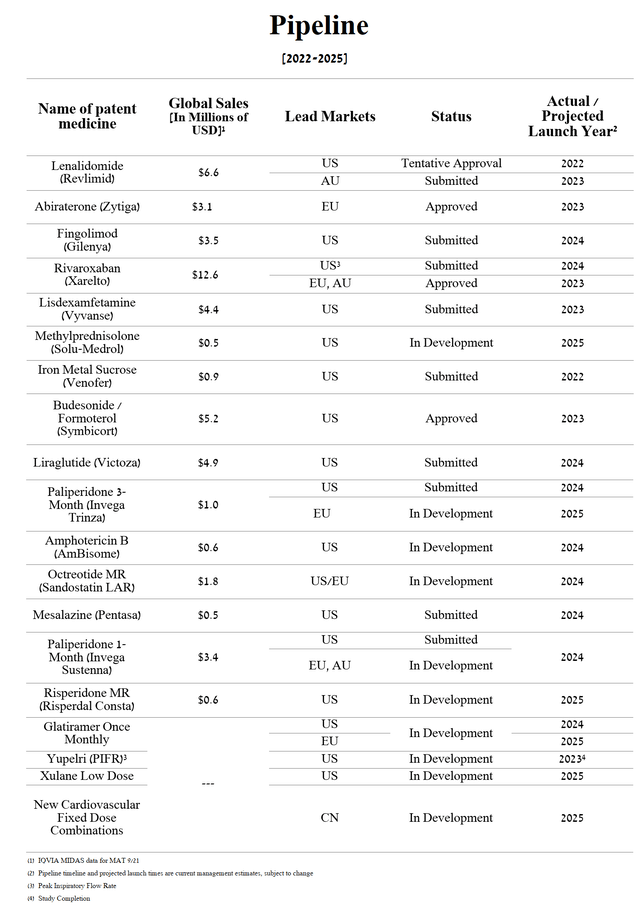

Comparability of product candidates in growth

One of many firms is extra targeted on generics, whereas the opposite has a extra diversified technique that features the event of biosimilars and patent medicines.

Viatris

At first look, the Viatris pipeline seems to have a bigger variety of product candidates, which in principle ought to end in a big increase to the corporate’s income progress.

Creator’s elaboration, primarily based on Q1 2022 Earnings Presentation

For my part, it is a deceptive impression, as Viatris maintains a enterprise mannequin that’s primarily targeted on the manufacturing of generics. Nevertheless, these medicines could be produced by many pharmaceutical firms which have manufacturing capabilities. Because of this, a number of dozen firms will share the patent drug pie, and in consequence, solely a small a part of it is going to go to Viatris. Thus, Viatris doesn’t have distinctive, patented medicine that would curiosity traders and create preconditions for a big improve in internet revenue. In distinction to that is the technique of Organon, which additionally has a portfolio of generics, however continues to enter into partnerships to develop next-generation patent medicines and biosimilars.

Organon

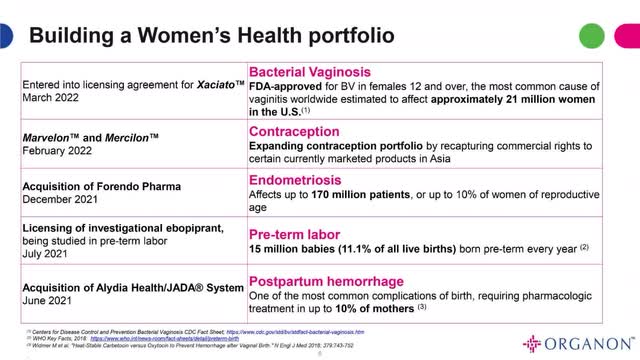

Organon’s technique is to develop the pipeline by partnering or buying firms whose product candidates are at an early or late stage of growth. In 2021, Organon entered into an settlement with ObsEva and bought Forendo Pharma, specializing within the remedy of ladies’s illnesses.

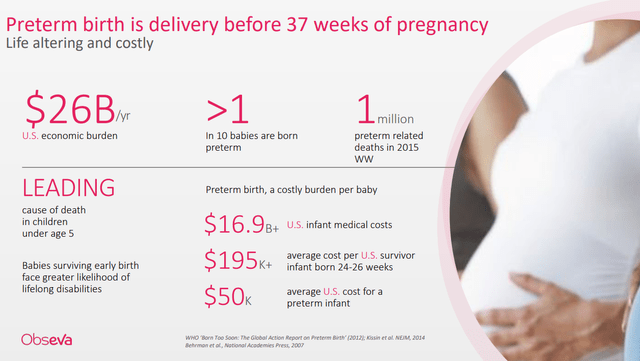

Some of the superior scientific packages amongst Organon’s M&A offers is ebopiprant (OBE022), which is being developed with ObsEva (NASDAQ:OBSV). ebopiprant is a candidate product that may be a selective prostaglandin F2α receptor antagonist and is being developed for the remedy of preterm labor by lowering inflammatory responses and uterine contractions. The corporate estimates that one in 10 infants is born prematurely, and because of the lack of FDA-approved medicine for the remedy of preterm labor (PTL), there are large alternatives for the industrial success of ebopiprant if authorized by regulatory authorities.

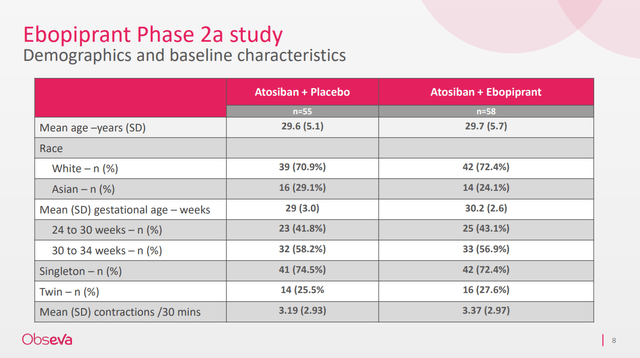

In November 2020, ObsEva introduced optimistic outcomes from a part 2a scientific trial involving 113 preterm delivery sufferers.

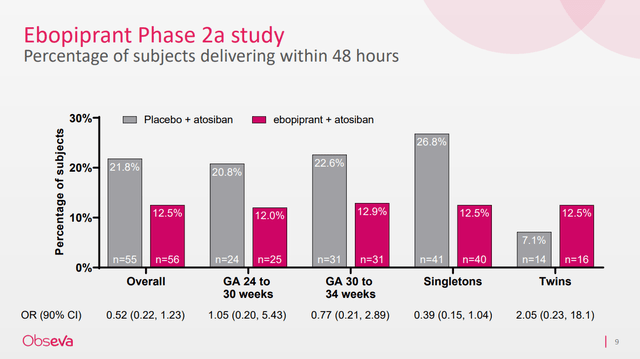

This examine confirmed the primary information on the effectiveness of ebopiprant, specifically, the addition of ObsEva’s product candidate to atosiban decreased the speed of supply in singleton pregnancies by 53.4% in contrast with the placebo + atosiban group. General, 12.5% of ladies who obtained ebopiprant gave delivery inside 48 hours of beginning remedy, in contrast with 21.8% of sufferers who took the placebo.

The protection profiles between topics within the ebopiprant group and people within the placebo group have been comparable. As well as, there was no proof within the part 2a scientific trial that using ebopiprant in pregnant ladies ends in damaging results on the event of the kid in comparison with these taking placebo.

Conclusion

Organon is a number one pharmaceutical firm within the growth and commercialization of medicines for the remedy of ladies’s illnesses. Whereas Viatris, shaped from the merger of Mylan with Upjohn, is a worldwide healthcare firm targeted totally on generics and biosimilars. Each firms have an intensive portfolio of authorized medicines, excessive dividend yields, and revenues. Nevertheless, because of a extra environment friendly enterprise growth technique, a diversified pipeline of product candidates, and considerably decrease multiples, I imagine Organon is extra promising in the long term. On the identical time, the Viatris enterprise is more likely to stagnate because of the sale of the biosimilar portfolio.