Mini

Indian biopharmaceutical firm Biocon has bought upto 5.1 % stake within the firm for a worth band of Rs 550 to Rs 573.

Biocon has bought as much as 5.1 % stake in Syngene Worldwide for a worth band of Rs 550 to Rs 573 to fund the fairness part of the $3.3 billion acquisition of biologics enterprise from Viatris.

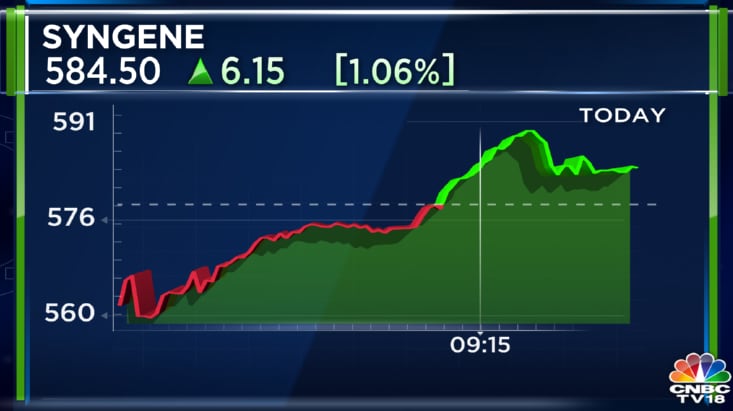

The shares of contract analysis and manufacturing agency Syngene Worldwide climbed 3.5 % in early commerce on Tuesday, September 6, after 2.3 crore shares of the corporate, price 5.7 % fairness, modified arms for Rs 564 per share.

Biocon inventory opened 0.8 % greater and subsequently fell 0.3 % on Tuesday.

Biocon has mentioned that the corporate is on monitor to shut the Viatris deal signed in 2022. As per the deal, for closing Biocon Biologics can pay $2 billion to Viatris. Of those 2 billion, the corporate will obtain $50 million from Viatris for capex, and $1.8 billion have been obtained from debt dedication. $335 million shall be deferred cost that the corporate can pay primarily by way of inner money era.

The remaining $800 million shall be generated by way of fairness dedication — this $800m fairness part is the explanation Biocon is promoting stake in Syngene.

$550 million shall be from previous and new PE buyers together with Serum that’s seeking to elevate stake in Biocon Biologics.

Biocon will discover fundraising choices reminiscent of promoting stake in Syngene to boost the wanted remaining $250 million.

Aside from Biocon promoters, Biocon Restricted Worker Welfare Belief holds 0.29 % stake in Syngene Worldwide, taking the overall stake to about 70.29 %.

Of the 12 analysts monitoring Syngene, 75 % give a ‘purchase’ ranking whereas one other eight % have given a ‘maintain’ on the shares of the corporate. 17 % have a ‘promote’ suggestion.

First Revealed: IST