The principle level of investing for the long run is to earn money. However greater than that, you in all probability wish to see it rise greater than the market common. Sadly for shareholders, whereas the Alliant Vitality Company (NASDAQ:LNT) share value is up 46% within the final 5 years, that is lower than the market return. In the meantime, the final twelve months noticed the share value rise 3.5%.

So let’s examine and see if the long run efficiency of the corporate has been in keeping with the underlying enterprise’ progress.

Nevertheless for those who’d relatively see the place the alternatives and dangers are inside LNT’s business, you’ll be able to take a look at our evaluation on the US Electrical Utilities business.

There isn’t any denying that markets are typically environment friendly, however costs don’t at all times replicate underlying enterprise efficiency. By evaluating earnings per share (EPS) and share value adjustments over time, we are able to get a really feel for a way investor attitudes to an organization have morphed over time.

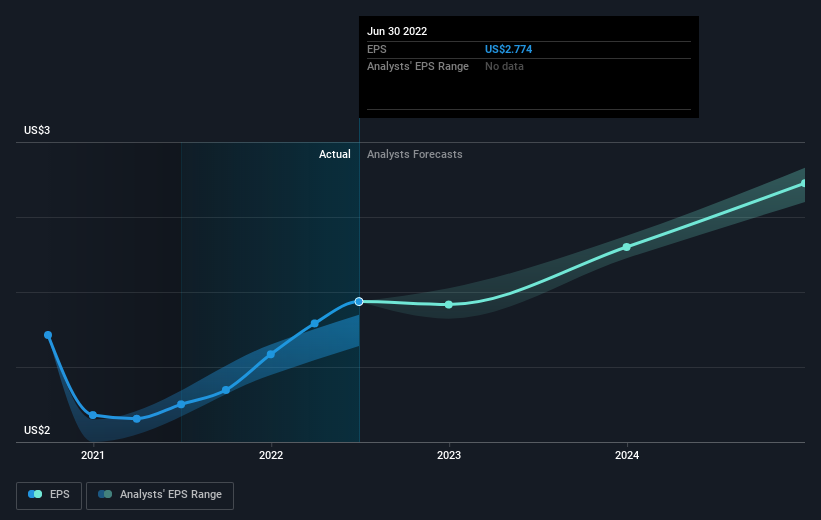

Throughout 5 years of share value development, Alliant Vitality achieved compound earnings per share (EPS) development of 10% per 12 months. This EPS development is larger than the 8% common annual improve within the share value. So it appears the market is not so enthusiastic in regards to the inventory today.

You’ll be able to see how EPS has modified over time within the picture under (click on on the chart to see the precise values).

We all know that Alliant Vitality has improved its backside line currently, however is it going to develop income? You possibly can take a look at this free report exhibiting analyst income forecasts.

What About Dividends?

You will need to contemplate the whole shareholder return, in addition to the share value return, for any given inventory. The TSR incorporates the worth of any spin-offs or discounted capital raisings, together with any dividends, primarily based on the belief that the dividends are reinvested. So for firms that pay a beneficiant dividend, the TSR is commonly loads larger than the share value return. Within the case of Alliant Vitality, it has a TSR of 70% for the final 5 years. That exceeds its share value return that we beforehand talked about. The dividends paid by the corporate have thusly boosted the whole shareholder return.

A Totally different Perspective

It is good to see that Alliant Vitality shareholders have acquired a complete shareholder return of 6.5% during the last 12 months. And that does embrace the dividend. Nevertheless, the TSR over 5 years, coming in at 11% per 12 months, is much more spectacular. The pessimistic view can be that be that the inventory has its greatest days behind it, however then again the worth may merely be moderating whereas the enterprise itself continues to execute. It is at all times attention-grabbing to trace share value efficiency over the long run. However to know Alliant Vitality higher, we have to contemplate many different elements. Take into account for example, the ever-present spectre of funding threat. We have recognized 2 warning indicators with Alliant Vitality (not less than 1 which is regarding) , and understanding them needs to be a part of your funding course of.

In the event you would like to take a look at one other firm — one with probably superior financials — then don’t miss this free record of firms which have confirmed they will develop earnings.

Please observe, the market returns quoted on this article replicate the market weighted common returns of shares that at present commerce on US exchanges.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by elementary information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Discounted money movement calculation for each inventory

Merely Wall St does an in depth discounted money movement calculation each 6 hours for each inventory in the marketplace, so if you wish to discover the intrinsic worth of any firm simply search right here. It’s FREE.

/cloudfront-us-east-1.images.arcpublishing.com/gray/FDV4XNVTWFGZ3EARERR5GG2JJM.jpg)