A take a look at the shareholders of Alliant Vitality Company (NASDAQ:LNT) can inform us which group is strongest. And the group that holds the most important piece of the pie are establishments with 75% possession. In different phrases, the group stands to achieve probably the most (or lose probably the most) from their funding into the corporate.

Given the huge amount of cash and analysis capacities at their disposal, institutional possession tends to hold a whole lot of weight, particularly with particular person traders. Therefore, having a substantial quantity of institutional cash invested in an organization is usually thought to be a fascinating trait.

Let’s take a more in-depth look to see what the several types of shareholders can inform us about Alliant Vitality.

Earlier than we take a look at the possession breakdown, you would possibly prefer to know that our evaluation signifies that LNT is doubtlessly overvalued!

What Does The Institutional Possession Inform Us About Alliant Vitality?

Many establishments measure their efficiency towards an index that approximates the native market. So that they normally pay extra consideration to corporations which can be included in main indices.

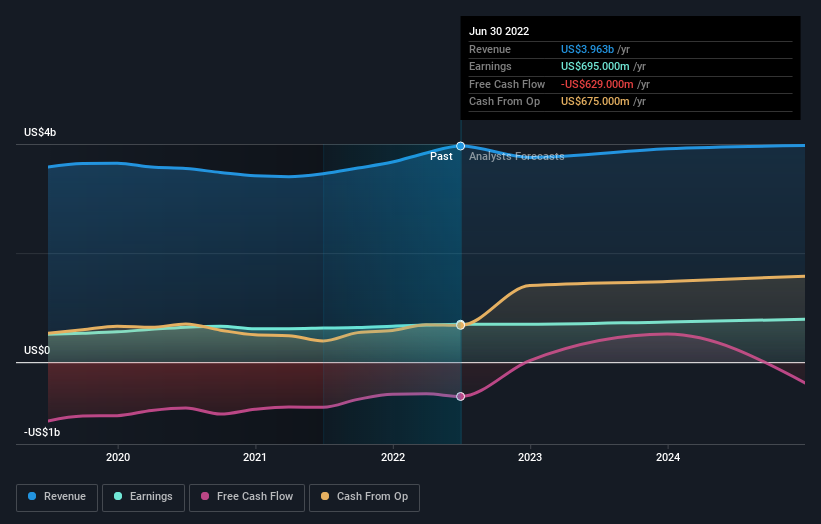

As you may see, institutional traders have a good quantity of stake in Alliant Vitality. This suggests the analysts working for these establishments have regarded on the inventory they usually prefer it. However identical to anybody else, they could possibly be flawed. If a number of establishments change their view on a inventory on the identical time, you might see the share worth drop quick. It is subsequently price Alliant Vitality’s earnings historical past beneath. In fact, the long run is what actually issues.

Buyers ought to notice that establishments really personal greater than half the corporate, to allow them to collectively wield vital energy. We notice that hedge funds haven’t got a significant funding in Alliant Vitality. Taking a look at our information, we are able to see that the biggest shareholder is The Vanguard Group, Inc. with 13% of shares excellent. BlackRock, Inc. is the second largest shareholder proudly owning 8.6% of widespread inventory, and State Road International Advisors, Inc. holds about 5.6% of the corporate inventory.

A more in-depth take a look at our possession figures means that the highest 21 shareholders have a mixed possession of fifty% implying that no single shareholder has a majority.

Whereas learning institutional possession for a corporation can add worth to your analysis, it is usually a great follow to analysis analyst suggestions to get a deeper perceive of a inventory’s anticipated efficiency. There are an inexpensive variety of analysts masking the inventory, so it is perhaps helpful to search out out their mixture view on the long run.

Insider Possession Of Alliant Vitality

The definition of firm insiders will be subjective and does differ between jurisdictions. Our information displays particular person insiders, capturing board members on the very least. Firm administration run the enterprise, however the CEO will reply to the board, even when she or he is a member of it.

Insider possession is optimistic when it alerts management are considering just like the true homeowners of the corporate. Nonetheless, excessive insider possession may also give immense energy to a small group throughout the firm. This may be damaging in some circumstances.

Our info means that Alliant Vitality Company insiders personal underneath 1% of the corporate. Being so giant, we might not count on insiders to personal a big proportion of the inventory. Collectively, they personal US$23m of inventory. On this type of scenario, it may be extra fascinating to see if these insiders have been shopping for or promoting.

Normal Public Possession

Most people, who’re normally particular person traders, maintain a 25% stake in Alliant Vitality. Whereas this group cannot essentially name the photographs, it could actually actually have an actual affect on how the corporate is run.

Subsequent Steps:

It is at all times price fascinated by the completely different teams who personal shares in an organization. However to know Alliant Vitality higher, we have to take into account many different elements. Like dangers, for example. Each firm has them, and we have noticed 2 warning indicators for Alliant Vitality (of which 1 is a bit regarding!) it is best to learn about.

However finally it’s the future, not the previous, that can decide how properly the homeowners of this enterprise will do. Due to this fact we predict it advisable to try this free report exhibiting whether or not analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing information from the final twelve months, which seek advice from the 12-month interval ending on the final date of the month the monetary assertion is dated. This will not be in step with full 12 months annual report figures.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to deliver you long-term centered evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Discounted money circulation calculation for each inventory

Merely Wall St does an in depth discounted money circulation calculation each 6 hours for each inventory available on the market, so if you wish to discover the intrinsic worth of any firm simply search right here. It’s FREE.

/cloudfront-us-east-1.images.arcpublishing.com/gray/FDV4XNVTWFGZ3EARERR5GG2JJM.jpg)