vicnt/iStock by way of Getty Photos

Viatris Inc. (NASDAQ:VTRS) is a inventory that has tempted us typically. It’s uncommon to seek out one thing that seems so low cost and on the identical time comes with actual, although manageable, dangers. We’ve got been sidelined and have stayed on the fence as we simply didn’t see an edge to the bull or the bear case. After we final lined it put up the epic selloff, we left just a little for the bulls to chew on. Particularly, we mentioned,

We predict the percentages are much more favorable at $11.30 and we preserve our worth goal of $15.00. Coloration us barely bullish right here although it isn’t sufficient for us to purchase the inventory contemplating the sheer abundance of alternatives in at this time’s markets.

Supply: Maybe An Overreaction

The inventory has gone basically sideways since then and is buying and selling at $10.95 as we write this. We glance at this time on the three key dangers for 2022 that are doubtless urgent on the valuation, regardless of the constructive deleveraging information from the Biocon deal.

1) Inflation

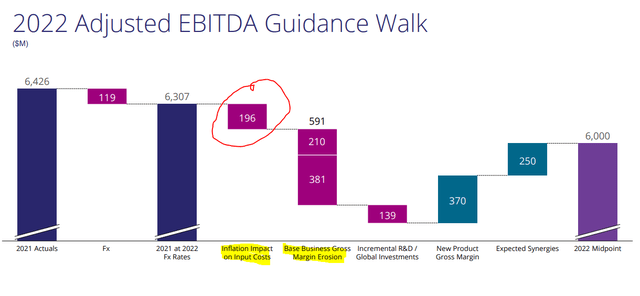

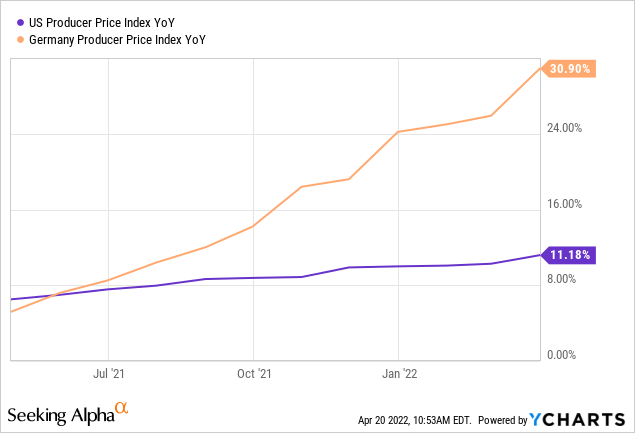

Traders must be residing on Mars to haven’t observed the havoc inflation is wreaking throughout portfolios. On this regard, it’s our perception that VTRS is considerably underestimating the affect by itself enterprise. Now it has recognized $196 million of affect from direct inflation. There may be additionally the opposite $591 million which it refers to as gross margin erosion. The latter is probably going a pricing energy challenge moderately than a direct inflation affect.

VTRS Adjusted EBITDA Steerage (VTRS This fall-2021 Presentation)

Okay, so now we have $196 million from inflation results. VTRS is utilizing that to scale back its 2022 estimated EBITDA, so every part ought to work out proper? We do not suppose so. The $196 million is only a shade over 1.1% of the income base.

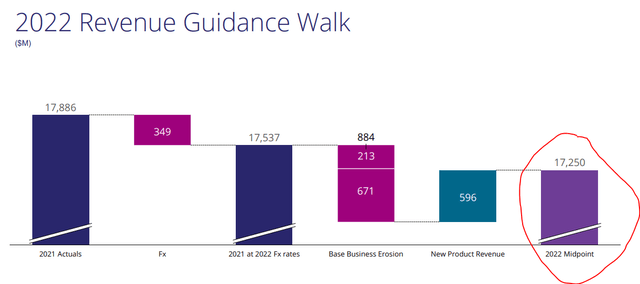

VTRS 2022 Income Steerage (VTRS This fall-2021 Presentation)

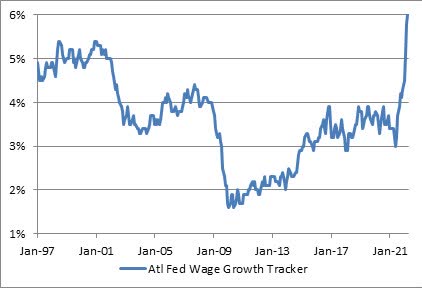

It’s 1.75% of the expense base ($17.25 billion of income minus $6.00 billion of EBITDA). That’s prone to be laughably low within the face of what now we have seen when it comes to value pressures. Wages, that are the largest element of bills, are rising at 6%.

Wage Inflation (Atlanta Fed)

Producer worth indices are rising at double-digit charges in US and in Europe.

None of this seems remotely suitable with a 1.7% value stress. It’s potential that some additional quantities are buried within the “base enterprise erosion” part. However on the entire, it is a very big danger which might completely break the bull thesis.

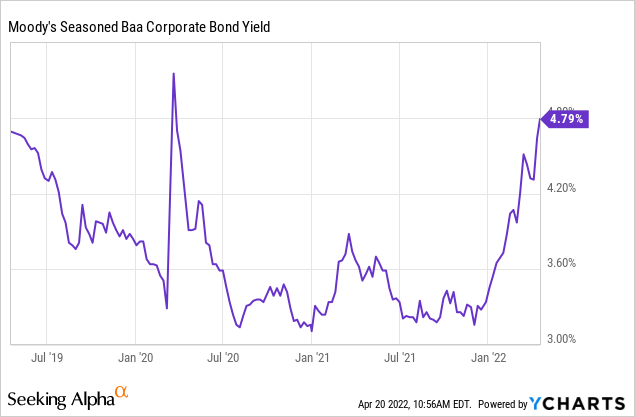

2) Curiosity Charges

VTRS has carried out some modest deleveraging in 2021 and the Biocon deal will likely be at the least credit score impartial if not credit score constructive. However what is going on on rates of interest is exterior its management. Baa bonds yields (final rung of funding grade) are spiking arduous.

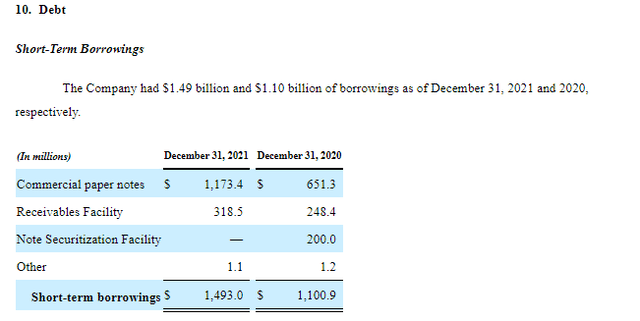

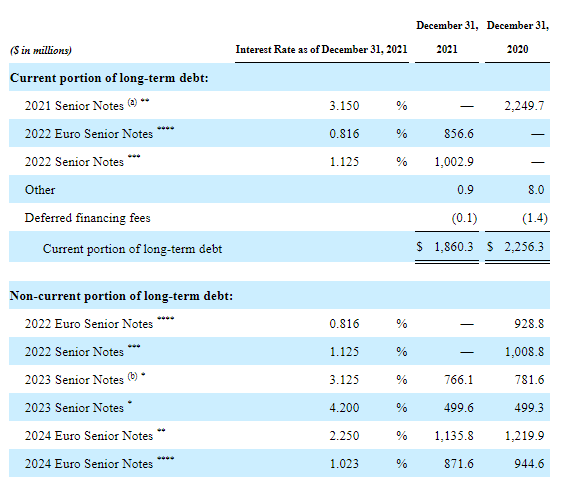

VTRS has $1.5 billion of business paper excellent and charges on this can rise quickly.

It has one other $1.86 billion to be refinanced inside a 12 months and $3.5 billion in two years after that.

VTRS Debt (VTRS 10-Ok)

VTRS had $636 million of curiosity expense in 2021 and we see that transferring up regardless of some deleveraging in 2023.

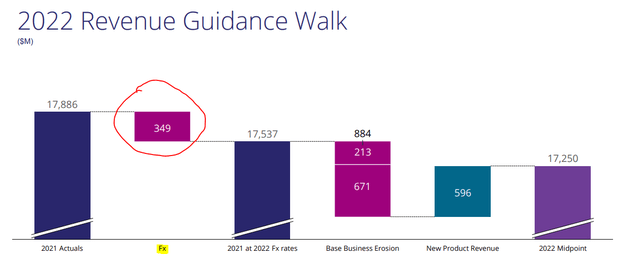

3) Foreign exchange Headwinds

Similar to the inflation steering, VTRS has taken into consideration forex headwinds.

VTRS This fall-2021 Presentation

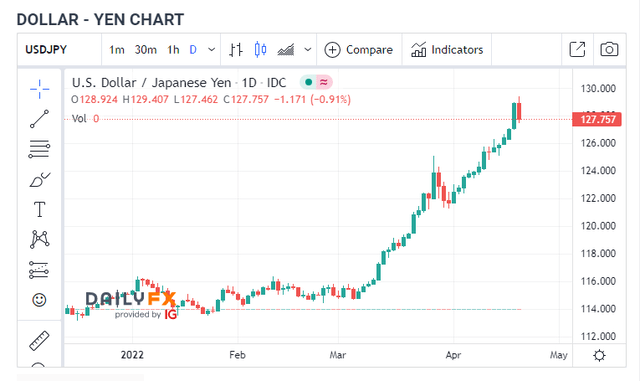

Similar to the previous case, we stay unconvinced that it has actually acquired the numbers proper. USD-YEN, for instance, has moved up 10% since that presentation.

USD-YEN Chart aka, Who Can Devalue Quicker (DailyFX)

The Euro has additionally weakened, though much less remarkably. This can harm the money stream, although there will likely be offset from the Euro and Yen denominated debt.

Verdict

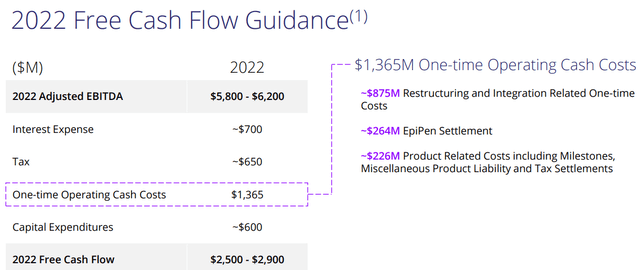

The three headwinds are materials in our opinion and sure break the adjusted EBITDA effectively beneath the $6.0 billion mark. Based mostly on VTRS’s walk-through, we see free money stream coming in underneath $2.3 billion once we add our estimates in.

VTRS FCF Steerage (VTRS This fall-2021 Presentation)

In fact, there additionally stays that eyesore of perpetual “one-time” prices coming in at $1.365 billion. This will likely additionally change into the largest bull weapon and a possible gamechanger in 2023. If these prices disappear sooner or later, it turns into simpler to purchase the bull thesis. That’s our strongest counterargument as to why no one ought to get excessively bearish. We’re nonetheless refusing to take place right here and ready for an ideal setup.

Please notice that this isn’t monetary recommendation. It might seem to be it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their targets and constraints.