Edwin Tan/E+ through Getty Photographs

The buildup stage is ‘straightforward’. Purchase development property and make investments inside your threat tolerance degree. On the core, you’ll personal fantastic firms (shares) and actual property. Take a complete return method as more cash buys and creates extra revenue. The retirement (decumulation) stage is extra sophisticated, however a profitable retirement will be attained by following some quite simple strategies. In retirement, we need to shield our wealth as we develop our wealth. We have to be prepared for bear markets and any drastic shifts in financial circumstances – see the surprising stagflation of the day. You would possibly think about the all-weather ETF portfolio for retirement.

I just lately provided the inventory portfolio for retirement.

We begin with the all-weather portfolio idea, however kinds of shares take the place of bonds, money and commodities. The shares are organized for financial circumstances – and we cowl all the bases.

Take a look at that shares for retirement submit, however right here I will even provide the inventory choice concepts for consideration.

On the core is a really defensive posture.

Defensive shares

Utilities – 10%

NextEra Vitality (NEE), Duke Vitality Corp (DUK), The Southern Co (SO), Dominion Vitality (D), WEC Vitality Group (WEC), Alliant Vitality (LNT)

Pipelines – 10%

Enbridge (ENB), TC Vitality (TRP), Enterprise Merchandise Companions (EPD), Vitality Switch (ET), ONEOK (OKE), Kinder Morgan (KMI).

Telecom – 10%

AT&T (T), Verizon (VZ), Comcast (CMCSA), T-Cell (TMUS), Bell Canada (BCE), TELUS (TU).

Telco REITs – American Tower (AMT), Crown Citadel (CCI).

Shopper Staples – 10%

Colgate-Palmolive (CL), Procter & Gamble (PG), Walmart (WMT), PepsiCo (PEP), Kraft Heinz (KHC), Tyson Meals (TSN), Kellogg, (Ok), Kroger (KR), Hormel Meals (HRL), Albertsons Firms (ACI).

Healthcare – 10%

Johnson & Johnson (JNJ), Abbott Labs (ABT), Medtronic (MDT), Stryker (SYK), CVS Well being (CVS), McKesson Company (MCK), UnitedHealth (UNH), Merck (MRK), Becton, Dickinson (BDX), Cigna Corp (CI), Moderna (MRNA).

Canadian banks – 10%

RBC (RY), TD Financial institution (TD), Scotiabank (BNS), Financial institution of Montreal (BMO).

Development property – 20%

Shopper discretionary, retailers, know-how, healthcare, financials, industrials, and vitality shares.

Apple (AAPL), Microsoft (MSFT), QUALCOMM (QCOM), Texas Devices (TXN), NIKE (NKE), BlackRock (BLK), Alphabet (GOOG), Lowe’s (LOW), Amazon (AMZN), TJX Firms (TJX), McDonald’s (MCD), Tesla (TSLA), Visa (V), Mastercard (MA), Raytheon (RTX), Waste Administration (WM), Berkshire Hathaway (BRK.A) (BRK.B), Broadcom (AVGO).

Inflation safety – 20%

REITs 10%

Agree Realty Company (ADC), Important Properties (EPRT), Regency Facilities Company (REG), STAG Industrial (STAG), Medical Properties Belief (MPW), STORE Capital Company (STOR), International Self Storage (SELF), EPR Properties (EPR), Realty Earnings (O).

Oil and fuel / commodities shares 10%

Canadian Pure Assets (CNQ), Imperial Oil (IMO), ConocoPhillips (COP), Exxon Mobil (XOM), Chevron (CVX), EOG Assets (EOG), Occidental Petroleum (OXY), Devon Vitality (DVN).

Agricultural

Nutrien (NTR). The Mosaic Firm (MOS).

Valuable and different metals

Teck Assets (TECK), BHP Group (BHP), Rio Tinto (RIO).

I additionally like the concept of taking part in the inexperienced vitality commodities supercycle.

The ETF Portfolio For Retirement

Whereas I like the concept and advantages of making a portfolio of particular person shares, the retiree can actually accomplish the all-weather activity by placing ETFs to work.

As soon as once more, on the core is a really defensive portfolio stance. The entrance line (and the portfolio) will be constructed round client staples (XLP), healthcare (IYH) and utilities (IDU).

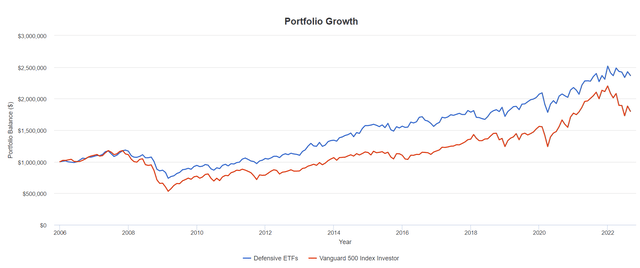

Right here is the defensive ETFs vs the S&P 500 in a decumulation take a look at. The spend charge is a considerably aggressive 4.8%. That’s to say every year, 4.8% of the whole portfolio worth is eliminated to fund retirement – there’s an annual enhance in revenue equal to inflation.

The interval is January of 2006 by means of to the top of August 2022.

Defensive ETFs vs S&P 500 (Portfolio Visualizer / Creator)

The defensive ETFs are basically 30-35% higher than the S&P 500. There’s sufficient development inside the defensive ETFs, and we expertise the advantage of much less drawdowns in market corrections.

Drawdown comparability

The next is based on Portfolio Visualizer.

Within the monetary disaster of 2008-2009:

- Defensive ETFs down 33.5%

- S&P 500 down 51%

Within the 2018 correction

- Defensive ETFs down 7.5%

- S&P 500 down 13.5%

Within the COVID pandemic correction

- Defensive ETFs down 14.3%

- S&P 500 down 19.6%

Within the 2022 rate-hike concern bear market

- Defensive ETFs down 5.8%

- S&P 500 down 20.0%

Be aware: Portfolio visualizer makes use of returns at every month’s finish. Drawdowns will be greater than proven. However the numbers and pattern are nonetheless very related.

Add inflation safety and we’re performed?

Contemplating that the defensive ETFs supply a slight beat of the S&P 500 on whole returns, and does so with much less volatility, you would possibly forego any of the extra growth-oriented ETFs (QQQ). Within the all-weather inventory portfolio, the defensive shares have been allotted at 60%, with 20% going to development shares.

On condition that, a number of the 20% development allocation may be moved to the defensive ETFs. You’d have 75% in client staples, healthcare, and utilities.

25% inflation safety is added.

75% protection / 25% inflation safety

For inflation safety, vitality shares rule. REITs are a really helpful runner up. You’ll be able to embrace pipelines as effectively that supply the potential of inflation safety whereas delivering a really strong yield.

Heres’ the inflation safety line-up:

The ETF portfolio for retirement

- 25% Shopper staples (XLP)

- 25% Healthcare (IYH)

- 25% Utilities (IDU)

- 10% – Vitality (XLE)

- 10% – REITs (ICF)

- 5% – Pipelines (TPYP)

Portfolio holes and issues

The portfolio is mild on worldwide diversification. That mentioned, most of the firms inside the indices are worldwide conglomerates. There’s worldwide publicity.

Buyers may add modest publicity to a world ETF similar to a core iShares (EFA) or on the potential of better worth the Schwab dividend providing (SCHY) or the Legg Mason Worldwide Low Volatility Excessive Dividend (LVHI).

Additionally, think about the Canadian banks that have been offered within the inventory portfolio for retirees.

Money and bonds

A money wedge shouldn’t be a foul thought. It helps your trigger throughout inventory market declines, stagflation, and deflation.

On condition that, a retiree would possibly go off the stock-only-script modestly with a 5%-10% weighting to money and/or quick time period bonds (SHY) and (ICSH).

You may also think about an allocation to treasuries (IEF) that supply some extra sturdy inventory market correction insurance coverage.

In my view, the optimum retirement portfolio holds retirement-friendly fairness property, but in addition contains modest publicity to money and bonds.

90% retirement-friendly all-weather ETFs – 10% money / bonds

Additionally, make sure that you perceive all tax implications. And do think about acquiring a better monetary plan.

Please use this text as a method for consideration, not blanket recommendation.

Learn. Determine. Make investments.

Thanks for studying.

We’ll see you within the remark part. How will you place for retirement? And in case you are in retirement. how is your portfolio holding up within the new stagflation regime? How did it maintain up within the COVID correction?

Remember to comply with me on In search of Alpha, or on my weblog – Lower The Crap Investing.

/cloudfront-us-east-1.images.arcpublishing.com/gray/FDV4XNVTWFGZ3EARERR5GG2JJM.jpg)