David Ziegler/iStock by way of Getty Photos

As a dividend development investor, I attempt to sustain with my watch checklist of over 100 shares that I both personal or wish to sometime maintain in my dividend development inventory portfolio.

Not all shares on my grasp checklist are buys at any given time. However it’s necessary to have my desired entry level in thoughts for these shares in order that I can seize the second after they do come all the way down to buyable ranges.

One inventory that at the moment appears to be a maintain is the electrical and pure gasoline utility Alliant Vitality (NASDAQ:LNT), which is a core utility place inside my portfolio. For the primary time since my earlier article final November, let’s focus on the small print of Alliant Vitality’s fundamentals and valuation to find out why I’ve downgraded the inventory to a maintain.

The Dividend Stays Secure

Other than a inventory’s working fundamentals (e.g., development outlook and monetary situation), I would argue that dividend development buyers ought to use two metrics in evaluating the security of a dividend.

First, Alliant Vitality’s 2.66% dividend yield is barely under the regulated electrical utility trade common of two.89%. This indicators that the dividend is prone to proceed rising. That is as a result of a decrease dividend yield usually signifies that a inventory is retaining extra of its earnings, which acts as a buffer to continue to grow the dividend in difficult environments. And it additionally signifies that an organization is investing extra capital again into rising its enterprise, which frequently interprets into rising earnings.

Second, Alliant Vitality produced $2.63 in non-GAAP EPS in 2021. In opposition to the $1.61 in dividends per share paid throughout the 12 months, that is equal to a 61.2% non-GAAP EPS payout ratio.

Alliant Vitality’s non-GAAP EPS midpoint is $2.74 for 2022 and its slated dividends per share for the 12 months is $1.71. The inventory’s non-GAAP EPS payout ratio will marginally enhance to 62.4% in 2022.

That is effectively inside Alliant Vitality’s goal payout ratio vary of between 60% to 70% of non-GAAP EPS (in keeping with slide 4 of Alliant Vitality’s March 2022 Investor Presentation). That is why I consider the dividend will develop a bit forward of earnings within the years forward. And with analysts forecasting 6.5% annual earnings development over the subsequent 5 years, I consider my 7% annual dividend development price is cheap.

Alliant Vitality Had An Glorious Yr

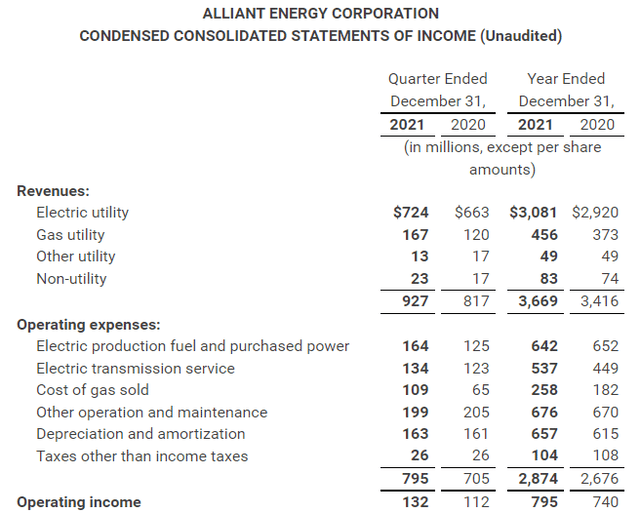

Alliant Vitality This autumn 2021 Earnings Press Launch

Alliant Vitality recorded $3.67 billion in income throughout 2021, which works out to a 7.4% development price over the year-ago interval (particulars sourced from Alliant Vitality’s This autumn 2021 earnings press launch).

In line with CFO Robert Durian’s opening remarks throughout Alliant Vitality’s This autumn 2021 earnings name, the corporate had one in every of its strongest years of incremental buyer development prior to now decade. This was one of many elements that defined Alliant Vitality’s strong income development.

The corporate’s gross sales to industrial and industrial prospects had been additionally up 1% over 2019 ranges as indicated by Durian. All of the whereas, gross sales to residential prospects remained modestly greater than 2019 ranges per Durian.

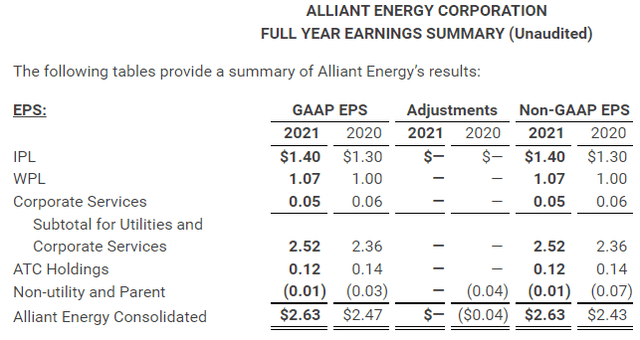

Alliant Vitality This autumn 2021 Earnings Press Launch

Together with Alliant Vitality’s greater income base, its non-GAAP web margin remained regular at 18% in 2021. This explains how the corporate’s non-GAAP EPS surged 8.2% greater year-over-year to $2.63 in 2021 (information in keeping with Alliant Vitality’s This autumn 2021 earnings press launch).

Searching over the subsequent 4 years, Alliant Vitality plans to separate $6.1 billion in capital investments between renewable initiatives, electrical distribution, and gasoline distribution. That is anticipated to lead to 6% annual development in its projected price base (figures per slide 11 of Alliant Vitality’s March 2022 Investor Presentation), which must also energy earnings development in that ballpark.

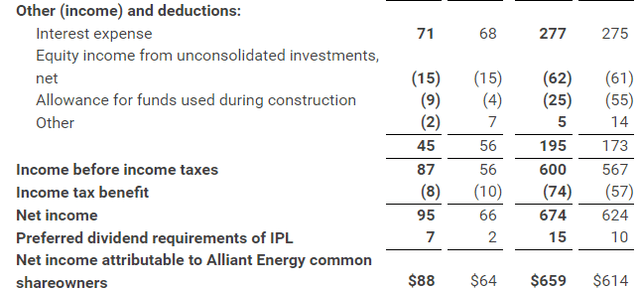

Alliant Vitality This autumn 2021 Earnings Press Launch

And if buyers are apprehensive that Alliant Vitality could not have the ability to afford such a big capital spending program to improve its infrastructure and develop its buyer base, they should not.

That is as a result of the corporate’s curiosity protection ratio improved from 3.1 in 2020 to three.2 in 2021 (calculations made out of information sourced from Alliant Vitality’s This autumn 2021 earnings press launch). Because of this the corporate is worthwhile sufficient to face up to a big financial downturn.

General, Alliant Vitality is a wholesome inventory whose fundamentals seem like intact. That is why the inventory could possibly be a fantastic purchase for long-term buyers on the proper worth.

Dangers To Take into account:

Alliant Vitality is a top quality inventory. However buyers want to pay attention to the near-term dangers that it faces.

The inventory’s 6% year-to-date acquire is considerably higher than the S&P 500 index’s 6% decline over that point. Nonetheless, Alliant Vitality’s inventory might underperform over the subsequent 12 months for a few causes.

As I’ve detailed in my final two articles, the inflation price in February 2022 surged 7.9% greater year-over-year. This might result in a higher than anticipated enhance within the firm’s prices, which could possibly be a drag on margins and earnings till regulatory commissions approve price requests.

There are different dangers to Alliant Vitality which might be linked to the decades-high inflation price. On one hand, the Federal Reserve could possibly be too aggressive with rate of interest hikes. This might propel the U.S. right into a recession, which might damage Alliant Vitality’s industrial and industrial gross sales. Then again, a relaxed method to price hikes might fail to curb inflation.

The Valuation Is not Ripe For Funding

Buyers are greatest served by insisting on investing in solely the most effective shares at smart valuations. I am going to use two valuation fashions to ascertain a good worth for Alliant Vitality’s shares.

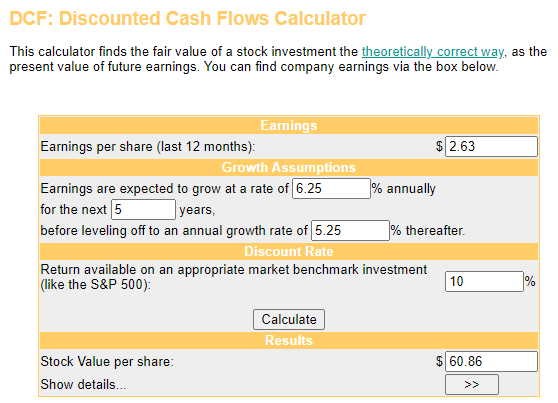

Cash Chimp

The primary valuation mannequin that I’ll make the most of to estimate the honest worth of shares of Alliant Vitality is the discounted money flows mannequin or DCF mannequin, which consists of three inputs.

The primary enter for the DCF mannequin is earnings over the past twelve months. This quantity is $2.63 in non-GAAP EPS for Alliant Vitality.

The following enter into the DDM is development assumptions. These should precisely be forecasted to supply a related honest worth output.

I am going to assume a 6.25% annual non-GAAP EPS development price via the subsequent 5 years and mannequin in deceleration to five.25% thereafter.

The ultimate enter for the DCF mannequin is the low cost price, which is one other time period for the annual whole return price that an investor requires from their investments. My private choice requires 10% annual whole returns.

Utilizing these inputs, I arrive at a good worth output of $60.86 a share. This suggests that Alliant Vitality’s shares are buying and selling at a 5.7% premium to honest worth and pose a 5.4% draw back from the present worth of $64.33 a share (as of April 7, 2022).

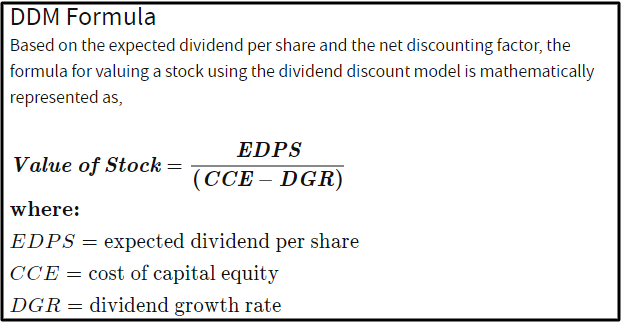

Investopedia

The opposite valuation mannequin that I am going to make use of to gauge the honest worth of shares of Alliant Vitality is the dividend low cost mannequin or DDM, which additionally has three inputs.

The primary enter into the DDM is the anticipated dividend per share, which is the annualized dividend per share. This quantity is at the moment $1.71.

The second enter for the DDM is the price of capital fairness, which is just the annual whole return price that an investor requires on their investments. I am going to once more use 10% for this enter.

The third enter into the DDM is the annual dividend development price or long-term DGR.

Whereas the primary two inputs into the DDM require minimal effort to retrieve the annualized dividend per share and to set an annual whole return price, accurately projecting the annual dividend development price requires an investor to ponder a number of parts: These embrace a inventory’s payout ratios (and whether or not they’re poised to stay unchanged, develop, or contract over time), future annual earnings development, trade fundamentals, and the well being of a inventory’s stability sheet.

As I alluded to within the dividend part above, I consider {that a} 7% annual dividend development price is sensible.

Factoring these inputs into the DDM, I’m left with a good worth of $57.00 a share. Because of this Alliant Vitality’s shares are priced at a 12.9% premium to honest worth and pose an 11.4% capital depreciation from the present share worth.

Upon averaging these two honest values collectively, I compute a good worth of $58.93 a share. This means that shares of Alliant Vitality are buying and selling at a 9.2% premium to honest worth and pose an 8.4% draw back from the present share worth.

Abstract: A Maintain For Now

With 19 straight years of dividend will increase underneath its belt, Alliant Vitality is simply 6 years away from changing into a Dividend Aristocrat. This can be a true testomony to the inventory’s high quality. Alliant Vitality’s steadily rising earnings and low non-GAAP EPS payout ratio make it virtually sure that it’s going to quickly change into a Dividend Aristocrat.

However the inventory’s rally this 12 months seems to have made an already totally valued inventory considerably overvalued. That is why I might be awaiting a retreat to the higher $50 vary earlier than contemplating including to my place in Alliant Vitality. Till then, I price the inventory a maintain.

/cloudfront-us-east-1.images.arcpublishing.com/gray/FDV4XNVTWFGZ3EARERR5GG2JJM.jpg)