Ivan-balvan/iStock through Getty Photographs

Funding Thesis

I’ve been bullish on Viatris (NASDAQ:VTRS) inventory in a number of earlier notes for Looking for Alpha, together with in the course of the time when the corporate – shaped through a merger between Pfizer’s spun out Upjohn legacy manufacturers division and generic drug large Mylan – nonetheless counted its biologics enterprise division as a part of the corporate.

As most traders will know, in April, Viatris elected to promote the biosimilars division to Indian Pharma Biocon in a $3.3bn deal – a choice that noticed its share worth fall by >30% in a single day, from $14.5, to $10. Biosimilars was arguably one of many extra progressive areas of Viatris’ enterprise – an space able to development, to offset the inevitable declines in gross sales of Pfizer’s legacy property.

As disappointing as the choice was – and the transaction is predicted to shut earlier than the tip of the 12 months now that antitrust clearances have been negotiated within the US and India – Viatris does retain a 13% stake in Biocon, having acquired $2bn in money, with one other $335m pledged to be paid in 2024, and the remaining $1bn in compulsorily convertible desire shares.

Viatris inventory seems to be engaging based mostly on a number of elements. The corporate is forecasting for revenues of $16.2bn – $16.7bn in FY22, adjusted EBITDA of $5.8bn – $6.2bn, and free money stream of $2.5 – $2.9bn.

If we deal with free money stream as web earnings, we are able to estimate a ahead earnings per share (“EPS”) determine of ~$2.2, and a ahead worth to earnings (“PE’) ratio of ~4.75x. A low PE ratio usually suggests {that a} enterprise is prospering and its valuation will rise. Presently, Viatris’ market cap valuation is $13bn, that means its ahead worth to gross sales ratio is <1x, which once more, in strange circumstances, hints at an organization being undervalued.

Viatris additionally pays a dividend – $0.12 this quarter, offering a yield of ~4.5% at present share worth. Administration’s acknowledged ambition is to make sure that the dividend stays above 25% of free money stream generated.

On the destructive facet, we all know that Viatris’ revenues are prone to shrink year-on-year as gross sales of legacy manufacturers corresponding to Lipitor, Lyrica, EpiPen and others decline within the face of generic competitors and new drug launches. We additionally know that Viatris has a excessive stage of debt – as of Q2 2022, the present portion of long run debt was $768m, and the long run debt itself stood at $19.2bn.

Since Q420, Viatris has diminished its debt from $25.1bn, to $20.4bn (in accordance with its Q222 earnings presentation), and its gross leverage from 3.7x, to three.3x. $1.5bn of debt was paid down in H122, and administration has additionally pledged to finish a $1bn share buyback program, which is one other fillip for traders on prime of the dividend.

Even so, most corporations have debt as a result of they’ve invested closely in R&D and predict prime line revenues to develop because of this, however Viatris doesn’t have this luxurious.

It hasn’t invested $25bn in new product growth, it has inherited $25bn of debt. Nearly as good a drug as Lipitor as soon as was – over the ldl cholesterol reducing medicine’ lifetime it has generated revenues of >$125bn, making it one of the crucial profitable pharmaceutical merchandise ever – its gross sales are usually not going to begin climbing once more.

Closely in debt, its most promising division offered off, and with falling gross sales, Viatris could also be undervalued relative to what it’s attaining as we speak, however what’s worrying the market is what it could be attaining tomorrow. So how does administration persuade the market in any other case?

It’s easy actually. Administration wants to revive perception in its merchandise and their gross sales potential, make sure that the corporate maintains or ideally will increase its profitability, and create a pipeline that traders can get enthusiastic about.

The choice state of affairs is that administration merely let issues slide, banking the earnings generated by legacy property and utilizing it repay debt – and pay themselves. Let’s take a look at every a part of the Product / Revenue / Pipeline trifecta in additional element.

Merchandise

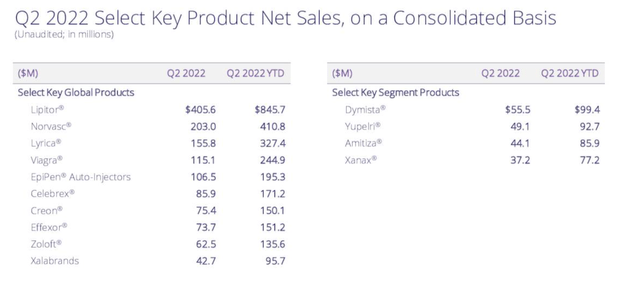

In Q222, Viatris drove web gross sales of $4.1bn – down 10% year-on-year. Manufacturers accounted for $2.48bn, or ~60% of revenues, Advanced Gx and Biosimilars $355m, or ~9%, and generics accounted for $1.27bn, or 31%. Worryingly, the generics division revenues have been down 17% year-on-year, while manufacturers have been down 8%.

Generics is a bit of the enterprise derived from Mylan, and one which I might have anticipated to be rising, however it’s shrinking, and nowhere extra so than in rising markets, a doubtlessly fertile marketplace for generics – gross sales have been down 42% year-on-year on this market nonetheless.

Viatris gross sales by drug Q222 (Viatris)

With gross sales of generics and types falling, and biosimilars being offered off, it appears clear that Viatris presently has no development prospects. It’s virtually behaving like a retailer holding a closing down sale.

Profitability

Shrinking prime line revenues doesn’t essentially make a enterprise a foul one. Largely, it is dependent upon profitability, and Viatris delivered free money stream of $719m in Q222 – a web margin of 18%, which is spectacular. FCF throughout H122 is even higher – $1.79bn – up 41% year-on-year – for a margin >21%.

Checked out within the context of debt, nonetheless, Viatris has generated $4.3bn of free money stream over the previous 6 quarters, sufficient to repay ~17% of its debt. Will probably be 5 lengthy years earlier than Viatris can say that it’s near eradicating the extent of debt it inherited, so traders mustn’t maintain out an excessive amount of hope of raised dividends and expansive share buyback applications, significantly when every passing 12 months ends in a decreased top-line contribution.

Forex headwinds have pressured administration to scale back its FY22 income steering, from $17bn – $17.5bn, to $16.2 – $16.7bn. Viatris does most of its enterprise abroad – however I might be extra involved about whether or not Viatris is actually an organization with world ambitions. That was the dream that was offered to traders in detailed March 2021 investor day presentation – there was speak of creating a “new sort of pharmaceutical firm” however the firm appears to have had its wings trimmed considerably since these hopeful days.

The fascinating query to reply is when falling prime line revenues turns into an issue for a corporation like Viatris. $16.5bn of revenues and a 25% revenue margin is arguably higher than $20bn of revenues and a 15% margin, however when does an absence of development turn out to be an issue? With a float of >1.25bn shares, traders are virtually sure to really feel the pinch sooner or later, and sizeable revenue margins could not appease them when web earnings is declining yearly.

On the Q222 earnings name, administration made it clear that it was lining up one other sale of a part of the enterprise – it isn’t clear what but, however traders could presumably must brace themselves for an additional M&A deal that negatively impacts the share worth.

Pipeline

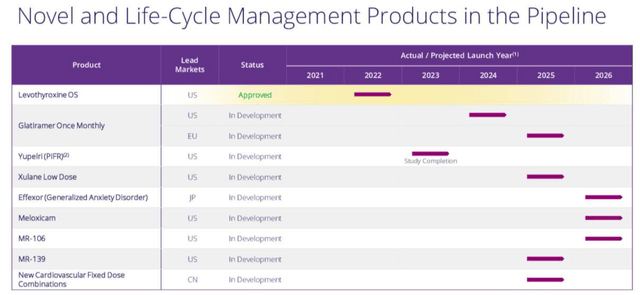

Within the close to time period, Viatris’ pipeline doesn’t instill nice confidence that declining gross sales of legacy manufacturers will be offset by the emergence of recent drug merchandise. A Levothyroxine generic has not too long ago received approval, with a complete addressable market of ~$4 – $5bn, of which it should doubtless solely declare a really minor share.

As we are able to see above, nonetheless, the subsequent approval will not be due till 2024, for a A number of Sclerosis generic, a model of Teva Prescription drugs Copaxone, which itself faces some stiff competitors. Gross sales >$500m would doubtless be miraculous. Issues appear to select up in 2025 and 2026, however traders ought to pay attention to the dual threats of the time worth of cash, and the excessive charges of failure related to the drug trial course of, even within the case of generics.

Briefly, Viatris has a pipeline, however whether or not it is sufficient to win over traders is debate-able. It seems to be slightly skinny, and a greater query could also be whether or not it’s even profitable over Viatris administration?

Conclusion: What Precisely Are Buyers Shopping for?

Viatris comes throughout as an organization that’s praying for a Benjamin Button model existence to me. It markets and sells a bunch of once-great, however now ageing property, corresponding to Viagra, Lyrica, and Lipitor, whose heydays won’t ever return, however whose comparatively meagre earnings can be utilized to repay the money owed accrued by Pfizer and Mylan earlier than the two corporations engineered this merger.

At first, administration seemed to be devoted to establishing Viatris as a generics and biosimilar drug producer and marketer of worldwide significance, however maybe it has all confirmed to be too tough. Growing a portfolio of <$500m p.a. promoting property should seem to be small potatoes when you could have Lipitor and Viagra in your secure. Viatris appears to have reinvented itself as an opulent retirement residence for ex-blockbusters.

There should come a topping level when traders cease admiring administration’s capability to pay down debt, engineer share buybacks, and supply a dividend, and start to marvel how they may get their a reimbursement when revenues are falling year-by-year – there should come a day when there’s not sufficient income to go spherical.

That isn’t essentially administration’s drawback, however traders who anticipated to see an thrilling new biosimilars participant emerge from the ashes of yesteryear’s blockbusters could find yourself upset and out of pocket.

Any firm that desires to achieve success in the long run must have a development plan, however it’s tough to discern exactly what that plan is within the case of Viatris.

Mylan’s administration group have been recognized for prioritizing their very own pay packets over working a profitable enterprise. I have never given up on Viatris but, however I ponder how a lot worse issues must get earlier than they start to look higher? It could possibly be a bumpy trip, however that may be preferable to an incremental slide.